NASHVILLE, Tennessee – Many hotels closed their doors temporarily at the start of 2020’s COVID-19 lockdowns, and data shows that how hotels recovered after reopening their doors depended heavily on location.

Ramp up is the time it takes for a hotel, either a new-build hotel or one closed for a significant length of time, such as during COVID-19 lockdowns, to achieve performance similar to others in its market or competitive set, or its own prior performance.

Typically, new-build hotels in the United States’ top 25 markets ramp up in about 15 to 19 months, achieving full comparable performance in occupancy, revenue per available room and average daily rate.

But how long did it take hotels that closed as a result of 2020’s COVID-19 lockdowns to recover performance once they re-opened?

Rate recovery happened relatively quickly for the most part, according to STR data presented by Ali Hoyt, senior director, consulting, at STR, at the 2021 Hotel Data Conference. STR is CoStar’s hotel analytics firm.

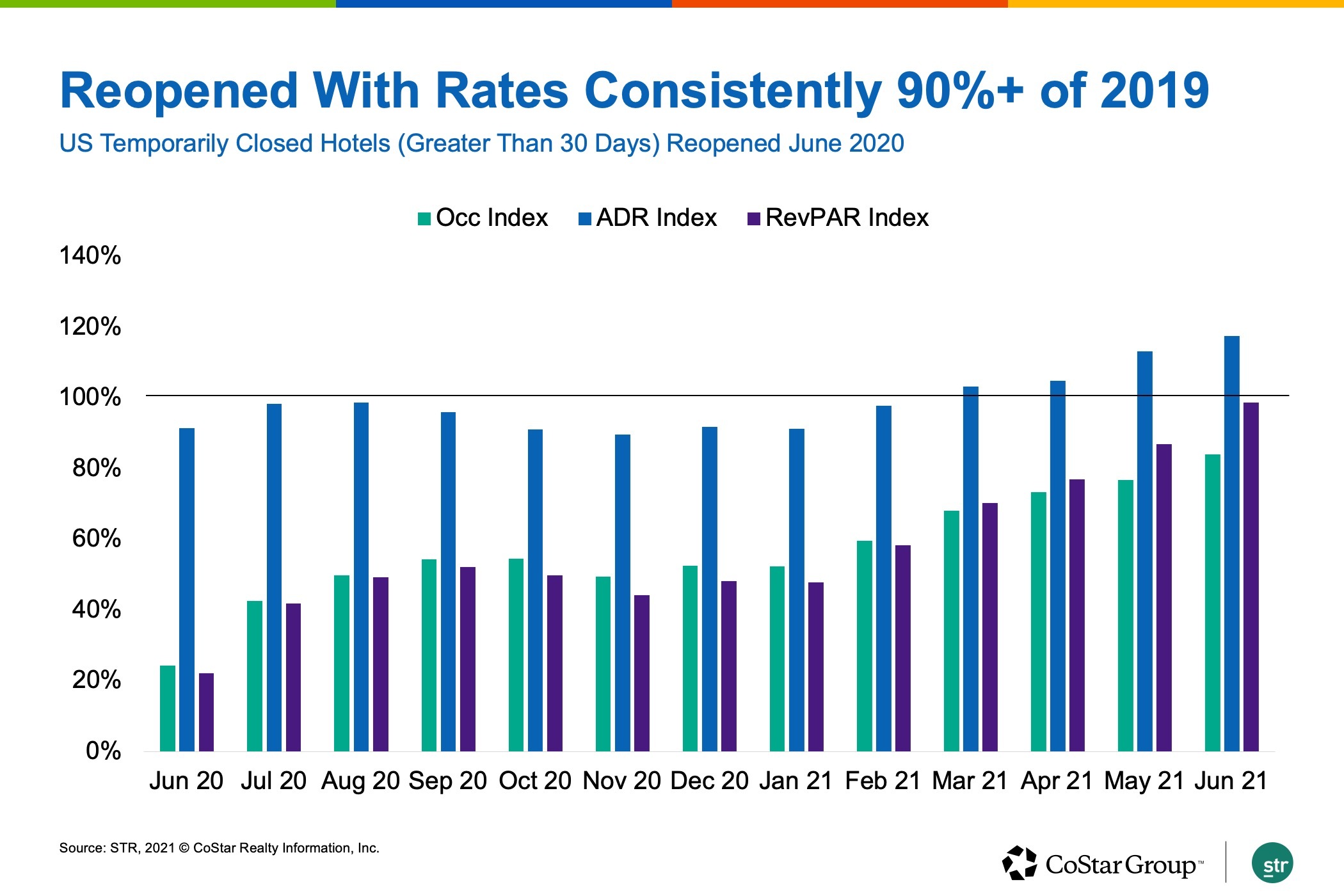

“Hotels that reopened in June 2020 after closing because of the pandemic did so at almost the same [average daily rates] they closed their hotels at,” Hoyt said. “This set achieved almost 90% of their 2019 rates in their first month open again.”

Nationwide Trends

Hoyt analyzed a sample of 1,060 U.S. hotels that closed at the onset of the COVID-19 lockdowns in 2020 and reopened in June.

She said it’s critical to factor in the demand drivers and business mix in a given market to determine how quickly hotels could ramp their performance up following temporary closures.

While closed hotels could recover rates fairly quickly upon reopening, it’s important to remember that in mid-2020, hotel occupancy levels still were low nationwide.

Data shows that by June 2021, 12 months after re-opening, “RevPAR is just about recovered, driven by much stronger rate growth than occupancy growth,” Hoyt said.

Occupancy continues to lag other key performance indicators.

Location Matters

Ramp-up performance in Miami and Boston illustrate two sides of the recovery coin, according to the data, showing how important location is when it comes to hotel performance recovery.

Miami hotels achieved 2019 RevPAR levels within 12 months “and reaching past that now, to nearly 160% of 2019 levels by month 19,” Hoyt said.

In contrast, Boston hotels that closed temporarily then reopened by June 2020 are nowhere near their 2019 performance levels.

“Boston has had strong ADR performance, but … this set is less than 40% recovered,” Hoyt said. “It’s a much longer road to recovery in these urban cores.”