A year into the pandemic, performance declines have become the norm in the hotel industry. Although still significantly in the red zone, improving hotel performance data shows the industry’s resiliency and growing confidence across global markets.

Business intelligence is key in keeping the industry’s growth and confidence. With that in mind, a closer look at hotel profitability levels by product type and room count could reveal trends that explain the extent to which performance has been affected by the pandemic.

More Offerings Equal More Hurdles

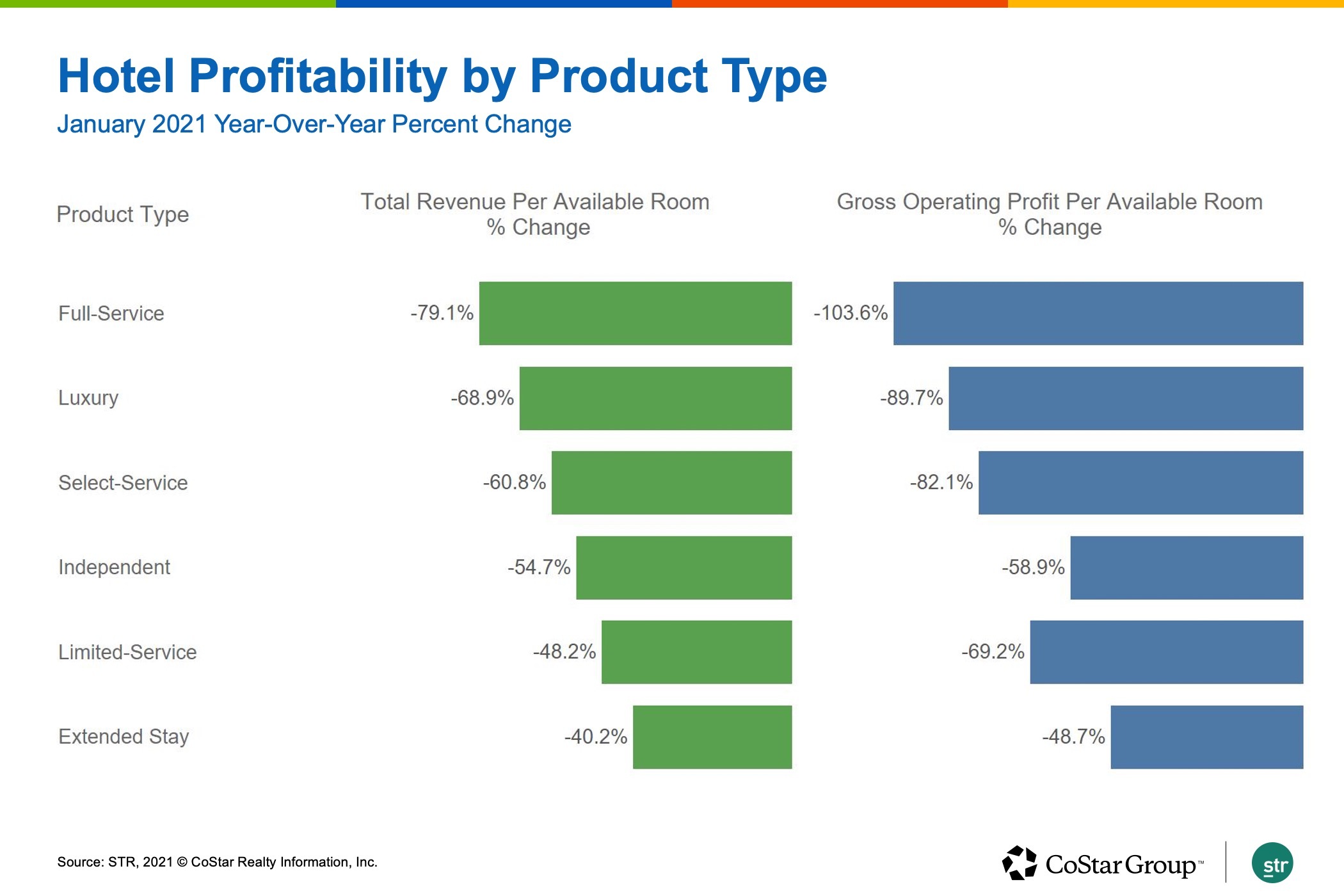

Some things are tacit knowledge in the industry, such as larger hotels will have more expenses, location is important and the current situation requires a bit of dexterity to maintain some degree of profitability. However, what exact characteristics can shine a light on profitability dynamics? When comparing performance of hotels by product type for January, a few points stand out.

Full-service hotels, which are most popular for groups and corporate transient demand, reported a total revenue per available room decline of 79.1%. Loss of event-driven revenue seems to have been the demise of profitability for these larger properties that thrive on group demand.

Luxury hotels draw similar demand as full-service hotels in addition to leisure transient demand. As such, these hotels posted strong declines in performance, as both leisure and corporate travel nearly vanished due to the pandemic. As luxury hotels offer more amenities, these properties have more revenue streams, but also more cost centers, resulting in the second steepest decline in both total revenue per available room and gross operating profit per available room.

Extended-stay hotels have less room turnover, and occupied rooms are usually not cleaned daily as is the case with other hotel types. Thus, they have lower costs in terms of cleaning supply and labor, yielding the lowest decrease in gross operating profit per available room (-48.7%) among hotel types.

As limited-service properties often do not have all amenities offered by other hotel types, such as a restaurant or bar, their operating costs are much lower and they run higher profit margins. Limited-service hotels have benefited from their popularity among “essential travelers” with tight budgets — the main demand drivers during the pandemic. Location was also important for these hotels, as suburban locations are mostly populated by limited-service hotels. Suburban markets were one of the location types that reported an uptick in demand during the pandemic, as city centers are not experiencing the usual corporate transient and group demand.

Independent hotels, most of which are smaller properties, benefited not only from the lower operating costs due to size, but also from less reliance on group and corporate transient travelers, while still attracting the few leisure travelers looking for a different landscape where they can practice social distancing.

Performance on Par With Hotel Size

Monthly profit and loss data shows how hotel size goes hand in hand with performance levels.

Larger hotels, not having their usual revenue streams from hosting events, experienced a 70.6% demand drop in January, yielding a sharp decline in total revenue per available room of 83.2%. The extra overhead costs that come with upkeep of larger properties and higher fixed costs posed an extra challenge to making a profit, thus equating to a sharp gross operating profit per available room decrease of 105.5% in January.

Smaller hotels experienced less dramatic drops in demand for the same period (-21.3%), yielding a total revenue per available room decline that was nearly half of that reported by larger hotels. Given that these smaller hotels already have limited staffing, reducing payroll costs was not as easy as it was for larger hotels, and they reported a sharp decline in gross operating profit per available room (-62.7%). Medium-sized and larger hotels reported stronger declines in revenue than smaller hotels as group and corporate demand was lost, but they benefited from reducing labor costs by 56% and 72%, respectively, compared to a 35% decrease by smaller hotels.

Based on the data, as the hotel offerings and operating intricacies increase, so does the complexity to yield any profit. Understanding these dynamics and tracking property-specific data can help hoteliers find alternative ways to increase revenue streams, or apply different cost-control approaches.

Claudia Alvarado is Analytics Manager with STR’s Consulting & Analytics team, based in Broomfield, Colorado.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.