Despite the challenges luxury and upper-upscale hotels have faced over the past year, the collapsed class has had moderate success in maintaining rate relative to the amount of demand lost. Through March 20, luxury and upper-upscale hotel demand reached only 45% of its 2019 level, but average daily rate in the segment remained disproportionately high, at almost 84% of its pre-COVID-19 level.

One of the most commonly touted explanations to this phenomenon is the “learning curve” theory: Hoteliers with high-end properties learned during the Great Recession that dropping rates wouldn’t necessarily increase recovery speed. As a result, hoteliers with luxury and upper-upscale properties stubbornly refused to drop rate over the past year.

While this is possible, it seems unlikely that only one small segment of the entire industry learned and applied this lesson in 2020. Another explanation, cited by Hilton VP of Analytics Jess Petitt during the forecast panel of the Hotel Data Conference: Global Edition, is that the demand mix changed more than rates.

Groups: Bigger Bookings, Lower Rates

Luxury and upper-upscale hotels split demand into three segments: transient rooms, booked in blocks of nine or less; group rooms, booked in blocks of ten or more; and contract rooms, a consistent block of rooms committed over an extended period with guaranteed payment. Of the three, contract demand holds the smallest share of total demand, accounting for only 4% of rooms booked in the first quarter of 2019, compared to 62% for transient and 33% for group.

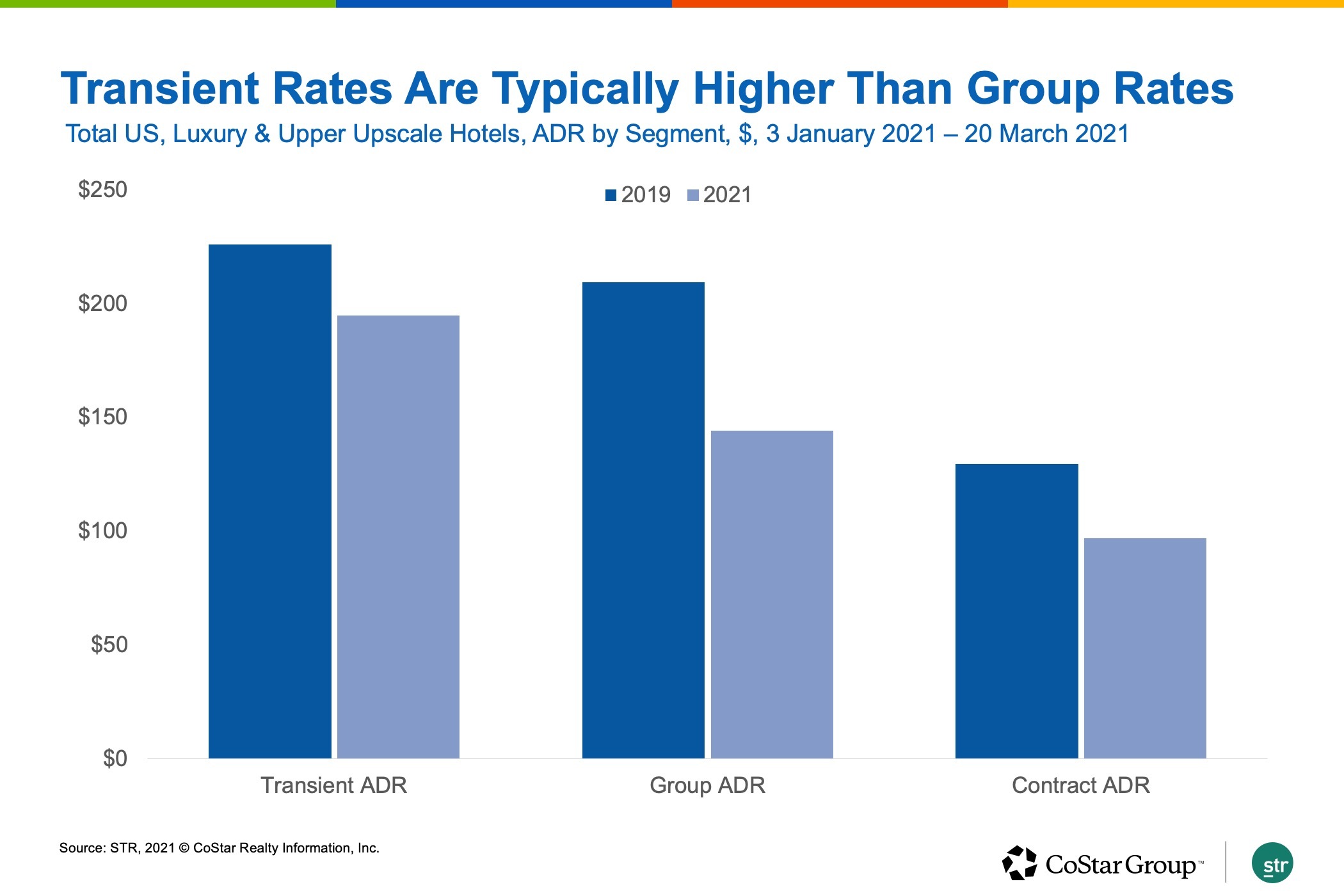

Groups typically book room blocks 12 to 18 months in advance, and negotiate rates at that time, which can lead to fluctuations in rate arising from hoteliers’ confidence in future demand. Group rooms also receive discounts and other considerations due to booking size, which can limit ADR. As a result, transient demand commands the highest rate of the three demand segments.

Segmentation Shifts

While both transient and contract demand felt the impacts of COVID-19-related travel slumps, group demand disappeared almost entirely as social distancing requirements drove conferences, conventions or other large events to cancel or “go virtual.” The loss of groups decimated high-end hotel performance, but their absence had a positive impact on luxury and upper-upscale ADR.

Splitting luxury and upper-upscale ADR into its three component parts reveals the secret to the segments' seeming ADR success over the past year. Group demand contributed $74 to total ADR in 2019, a figure which shrank nearly 70% in 2021 as groups canceled or dramatically changed their events.

Group absence shifted the demand mix, and high-end hotels came to rely on transient travelers to boost performance: Between 2019 and 2021, transient demand accounted for an additional $16 of total rate.

This pushed luxury and upper-upscale hotel ADR in two ways. First, the shift from lower group rates to higher transient rates caused a substitution effect that pushed rate. Second, while both transient and group rate declined from their 2019 highs, transient rates fared better than groups, reaching 86.3% of their 2019 levels in 2021 compared to only 68.9% for groups.

ADR Advantage

The shift in ADR components from group and into transient meant that even as transient demand declined from its 2019 highs, its increasing importance and higher probability compared to group ADR muted the overall decline in luxury and upper-upscale hotel rate.

As a result, while high-end hotel demand remains at less than 50% of its pre-pandemic level, ADR has reached nearly 84% of its 2019 level — second only to the relatively high demand for midscale and economy class hotels. Put another way, 2021 transient ADR, while down 13.7% from 2019, has declined only 7% from 2019 group rates. The shift to transient demand has significantly helped to hold rates.

Conclusion

Of course it’s likely that revenue management strategies and analysis of performance during prior downturns has played a role in setting high-end hotel rates. The segmentation shift, however, has proved an unexpected but very welcome boon for the hotel class that has been most damaged by the COVID-19 pandemic.

Kelsey Fenerty is a research analyst at STR.

This article represents an interpretation of data collected by STR, CoStar's hospitality analytics firm. Please feel free to comment or contact an editor with any questions or concerns.