LOS ANGELES — Though tempered by the ongoing pandemic and the labor challenges the industry faces, hotel executives at the first day of the 2022 Americas Lodging Investment Summit expressed overall optimism in the recovery of hotel demand and performance.

Attendees at this year’s conference have been buoyed by strong leisure travel and are eager to make deals, either in acquiring properties or in acquiring other companies. It’s a new year with new opportunities, and while COVID-19 persists and affects all parts of the industry — including demand, labor and the supply chain — hoteliers are prepared to make the most of it.

Photos of the Day

Quotes of the Day

“I learned throughout my career that you can love the work you do, but if you don’t love the people, it’s not going to work. If you like the work but love the people, it’ll all fit together.”

— Leslie Hale, president and CEO, RLJ Lodging Trust, on advice for newcomers to the hotel industry.

“It's pretty brutal. I mean, the notion of doing key money a couple years ago almost didn't exist at the management company level. So it's almost like overnight, that's an expectation.”

— Doug Dreher, president and CEO of The Hotel Group, on how competitive the landscape is to land third-party management contracts.

Data Point of the Day

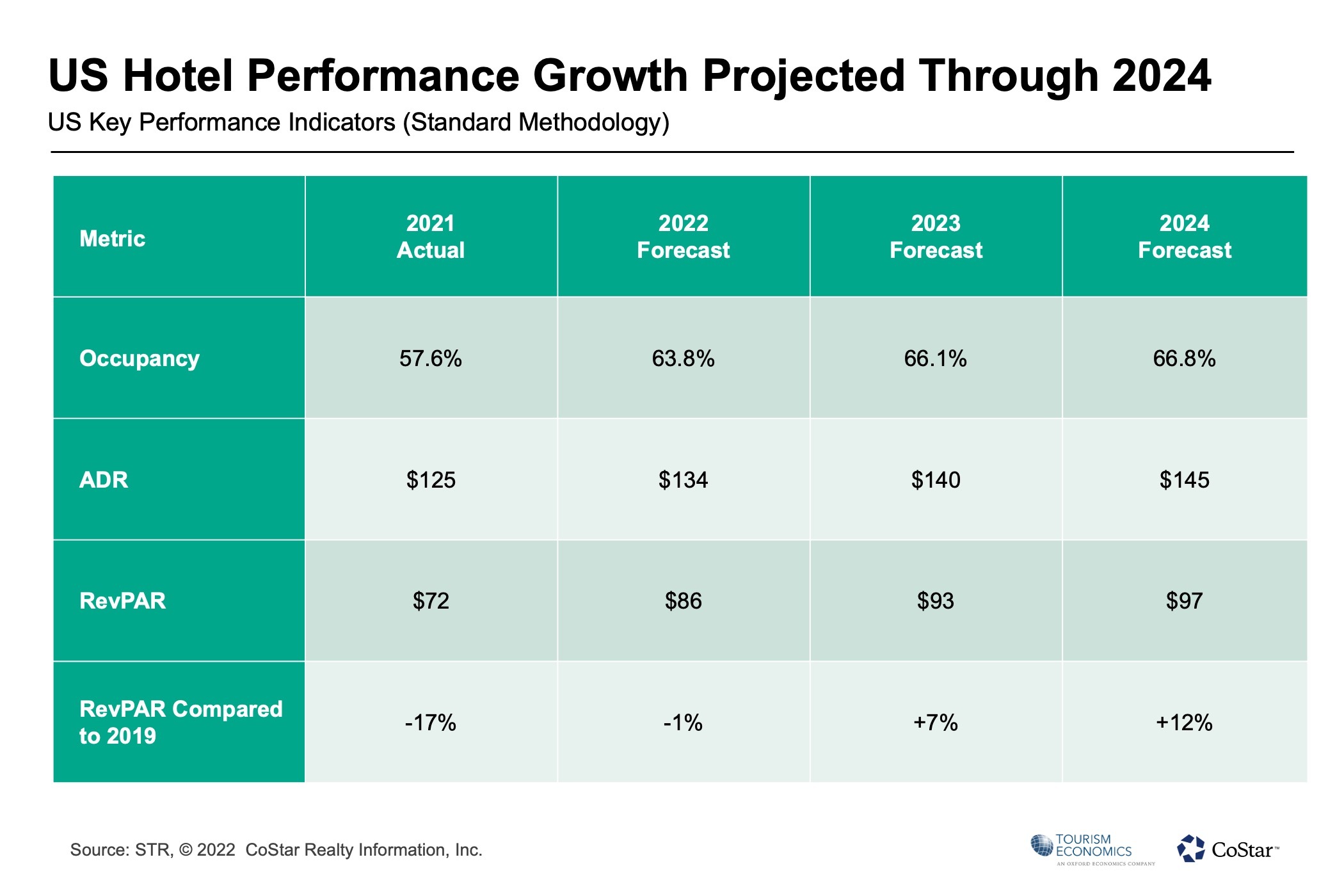

STR forecasts the U.S. hotel industry should reach peak occupancy in 2023. In 2024, as group and business transient travel returns, the industry is expected to set a new occupancy record.

Editors’ Takeaways

Even though the U.S. is dealing with the highest daily number of COVID-19 cases ever recorded, the mood at the Americas Lodging Investment Summit is far more upbeat than it was just six months ago. Back in July, hoteliers were feeling pretty good about improving performance over the summer, but a surge in cases from the delta variant dampened spirits considerably. Predictions on the return of business travel during the fourth quarter didn’t come true, at least not at the level they had hoped.

Hotel executives taking the stage at this conference were bullish about leisure travel and its potential for further growth. Marriott International President Stephanie Linnartz pointed out that the leisure segment is four times the size of business travel and has been growing at a faster pace than even before COVID-19. The latest variant, omicron, has caused some disruption, but leisure travel remains resilient, and groups have been rebooking instead of just canceling.

Hoteliers have tempered their expectations for business travel, but still expect it will come back in some form or another. It’s not a question of if, but of when and how.

— Bryan Wroten, senior reporter

@HNN_Bryan

The theme of this year’s Americas Lodging Investment Summit is “Turning the Page,” and for once I think a business conference theme actually works! 2020 and 2021 had their ups and downs, but 2022 is here, and the hotel industry is living in the here and now. That means hoteliers are making do with the realities of today’s hotel business. Labor continues to be a problem, but it is becoming more clear what hiring and retention tactics work better than others. Hoteliers can work with that. Visibility into how people travel at least here in the U.S. also is a little more clear — leisure continues to drive, group is coming back and business transient absolutely needs to come back — and hoteliers can work with that, too.

Looking forward, the return of the business-transient segment and changes in international travel will have an impact on recovery as we head into the midpoint of 2022. High-value, business-transient travel absolutely has to come back, hoteliers said on this first day of ALIS. What’s the holdup? In part it’s the fact that many U.S. business travelers aren’t back to working in their offices yet. Hoteliers predict that the high-end leisure travel boom the U.S. has enjoyed particularly in the summer months over the past two years may dampen as Americans still flush with disposable income head out of country to spend it instead of staying here.

But overall, hoteliers have moved past some of the stages of grief inherent in the pandemic and have some renewed excitement for what’s next for the industry.

— Stephanie Ricca, editorial director

@HNN_Steph

If you own a third-party management company, and you want to get out of the business, you’ll find no shortage of buyers. That was the recurring theme during the first day of ALIS, particularly at the Lodging Industry Investment Council meeting held in conjunction with the event.

Multiple industry leaders openly professed their desire to expand their platforms by buying their competitors. Obviously, this trend has been ongoing for a while, and was underscored as recently as this week with TPG Hotels & Resorts’ purchase of Marshall Hotels & Resorts.

During a morning interview I conducted with Remington Hotels President and CEO Sloan Dean, he openly professed his desire to buy another hotel management platform. He noted there are clear benefits to the scale that would add, but those benefits begin to diminish somewhere around the 150-hotel mark.

— Sean McCracken, news editor

@HNN_Sean