Executives at French hotel firm Accor are feeling confident enough to issue revenue per available room guidance for full-year 2023.

“RevPAR expectation of between 5% to 9% in 2023. We feel strong enough to state this, and we usually do not do this until later in the financial year,” said Jean-Jacques Morin, Accor’s chief financial officer and deputy CEO, during a full-year 2022 earnings conference call.

Accor Chairman and CEO Sébastien Bazin said on the call the company exceeded its financial and non-financial targets and could look to the future with serenity.

Bazin said in the years he and Morin have led the firm, it has never underperformed the guidance given earlier in any year, except for the COVID-19 years that were out of its hands.

“[Morin and I] discussed this a few days ago, and I can tell you earnings before interest, taxes, depreciation and amortization will increase double digits. I can tell you that,” Bazin said. “We wanted to provide a positive signal that 2023 numbers will be better than 2022 numbers.”

Hotel-industry challenges are being met by Accor, executives said. Bazin said the business plan of his 10 years heading the company was to “get [asset] light, then get broad and then get fit.”

“Now it is to get focused. Let’s get our act together, get EBITDA where it should be,” he said.

Inflation remains a concern, but it is stabilizing in Europe, and travel is back in full swing, Bazin said.

Bazin pointed to statistics that showed globally 13.7 billion domestic room nights were booked in 2019, but 14.5 billion were booked in 2022. The expectation for 2023 is 15.85 billion room nights.

International travel is catching up, although room nights globally remain 37% down compared to 2019.

“Americans are back. There have been zero Chinese travelers, but 150 million Chinese will start to move, with 80% of them traveling within Asia,” he said.

Asia-Pacific, dragged down by Greater China, is the only region in Accor’s portfolio not to achieve RevPAR exceeding 2019 levels during the third and fourth quarters of 2022.

Morin reminded analysts that 2022 started with the omicron variant of COVID-19 and a subsequent dampening of early-year demand. He said the 2022 results signified a “momentous milestone.”

Morin also has reached a milestone in his career, leaving his position of CFO to become CEO of Accor’s premium, midscale and economy group.

Bazin said the group constitutes “an enormous organization, which is 90% of the number of hotels of this group and roughly two-thirds of the cash flow.”

“It is a new life, it is a new adventure, and it is perfect timing for [Morin] to go deeper,” he added.

The search for a new CFO has started, and the new hire would start in early May. Morin will continue in the role until that time and remains as the firm’s deputy CEO.

Revenue for the group increased 4% over 2019 levels and 80% over 2021.

“All this profit falls nicely into cash,” Morin said.

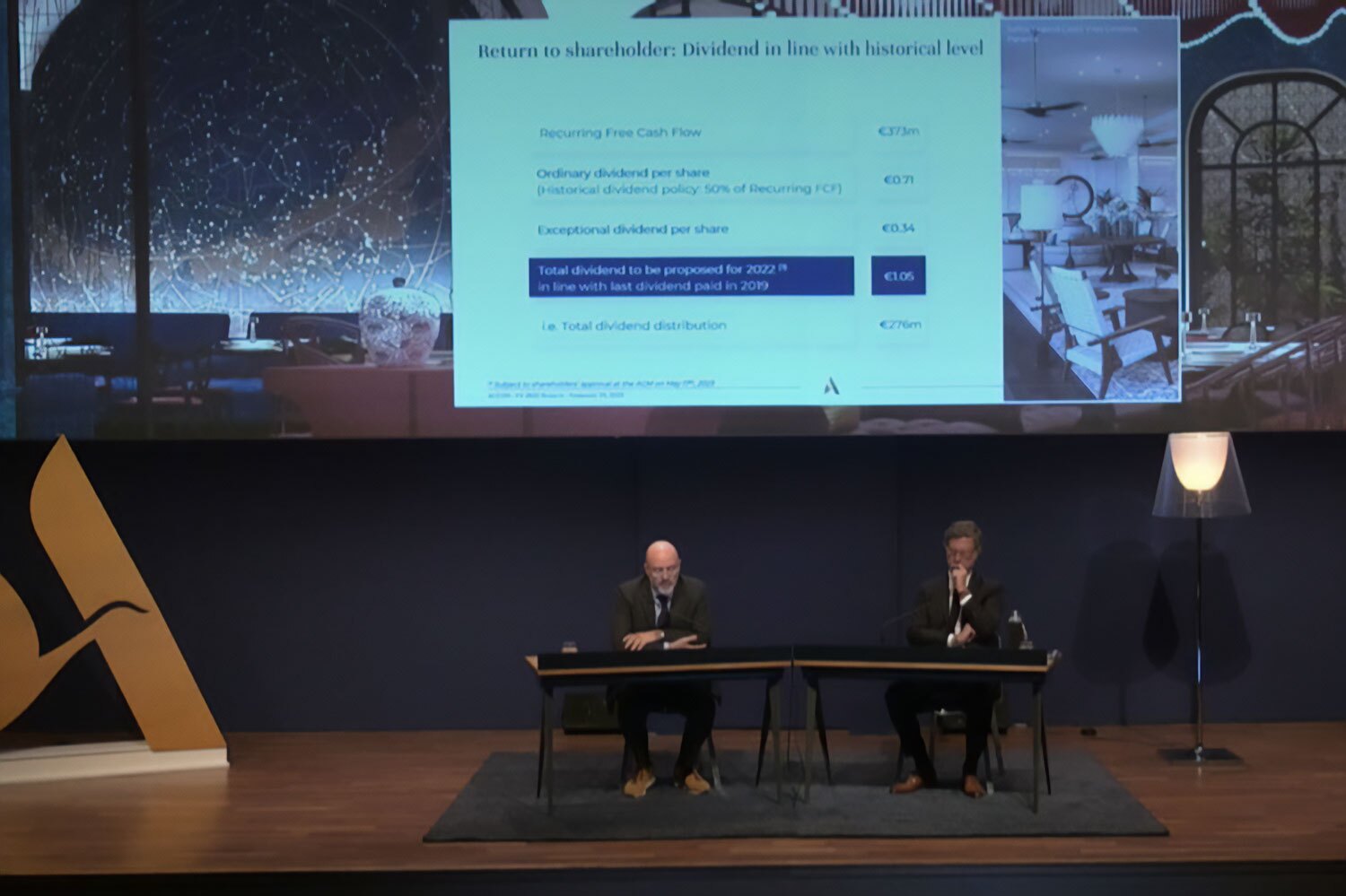

He said recurring free cash flow for 2022 was 373 million euros ($397 million), an improvement from 2021 when free cash flow was a negative 246 million euros; and net debt dropped from 1.84 billion euros in 2021 to 1.66 billion euros in 2022.

Morin added that in Accor’s major market of Europe, RevPAR performance was driven by France, where the metric was up 13% in the fourth quarter compared with the same period in 2019.

Accor's hotels in southern Europe posted a year-over-year increase of 12% for the same period, while in northern Europe, RevPAR was up 5%, he said.

Bazin said international tourists have returned to Paris.

Consolidated EBITDA in 2022 was 675 million euros, a huge increase from the 22 million euros posted in 2021 and better than the high end of Accor's guidance, issued in September, of 640 million euros. Still, it was 11% below 2019 levels in like-for-like terms.

Travelers and Margins

Bazin said one question remaining is China, but the outcome will be positive.

“How fast and strong will be its comeback of its 150 million travelers, and where will they go? In terms of market pricing, [each destination] is not the same,” he said.

Bazin said the firm has no fears over pricing.

“We see the willingness of people to spend more on travel and hotels … and there also is an increased capacity in transportation,” Morin said.

The firm opened 299 hotels and approximately 43,000 rooms across 2022, a 3.2% increase in its network size.

In total, its open portfolio now has 5,445 hotels and 802,269 rooms, with a pipeline of 1,247 hotels and approximately 216,000 rooms in development.

Bazin said that 3.2% increase delivered a higher margin in fees than the 5.5% added to its network across 2019.

He added in June the company will deliver a deeper look at how its recent reorganization will boost performance and “reap the benefit of the simplified, more focused model.”

The reorganization “has to be cost-neutral, and that has been acknowledged, and that is across 12 to 14 months, not within three,” Bazin said.

He emphasized it was a case of “volumes and margins, not percentages.”

Past Three Months

At the end of 2022, Accor completed exclusive negotiations with investment bank Valesco Group for the sale of its headquarters in Issy-les-Moulineaux, a suburb of Paris. The deal had a price tag of 465 million euros, subject to a 12-year, sale-and-leaseback agreement.

Accor was a tenant of the building between 2015 and 2018, at which time it bought the headquarters for 363 million euros.

In January 2023, Accor sold the remaining 3% it owned in H World Group, formerly known as Huazhu Group, for $460 million, which it said will help it further simplify its balance sheet and “finalize the value creation of the investment initiated in 2016.”

Its cumulative disposal value in the Chinese firm since 2019 equals $1.2 billion, from an initial investment of less than $200 million.

The master-franchise agreement between the two entities, which has resulted in more than 450 economy and midscale hotels in China, will continue, with a pipeline of more than 190 properties over the next three years.

In January, Accor also launched its 45th brand, Handwritten Collection, which is a midscale collection to complement its upper-upscale and luxury collections, MGallery and Emblems, respectively.

The new brand opened two hotels on the day of its launch, opened two more in February and has an additional nine signings, with five hotels likely to open by the end of the year.

As of press time, Accor stock was trading at 30.55 euros ($32.49) a share, a decrease of 6.28% year over year. The Euronext Stock Exchange was down 11.4% over the same period.