Demand for U.S. hotel rooms reached its seasonal apex as more than 28.4 million were sold in the week ending July 23 — the most since mid-2019.

Weekly room demand was also in the top 10 of the past 22 years, according to data from STR, CoStar’s hospitality analytics firm. The U.S. hotel industry sold 301,000 more room nights than it did in the prior week, the largest week-over-week increase for this week since 2011.

This annual demand peak was expected as it has occurred during this week — week 30 — in 15 of the past 22 years. While strong, it was not the best week 30 ever. That honor remains with 2019 when 29.4 million rooms were sold. This year’s result, however, will go down as the fourth best for this particular week.

U.S. hotel occupancy also reached a pandemic-era high of 72.8%, the highest level since early August 2019.

Pricing power continued to strengthen, as nominal average daily rate rose by less than 1% week over week to $158.79 — the second-highest nominal level recorded by STR since 2000, and just 69 cents below the record achieved at the start of the year.

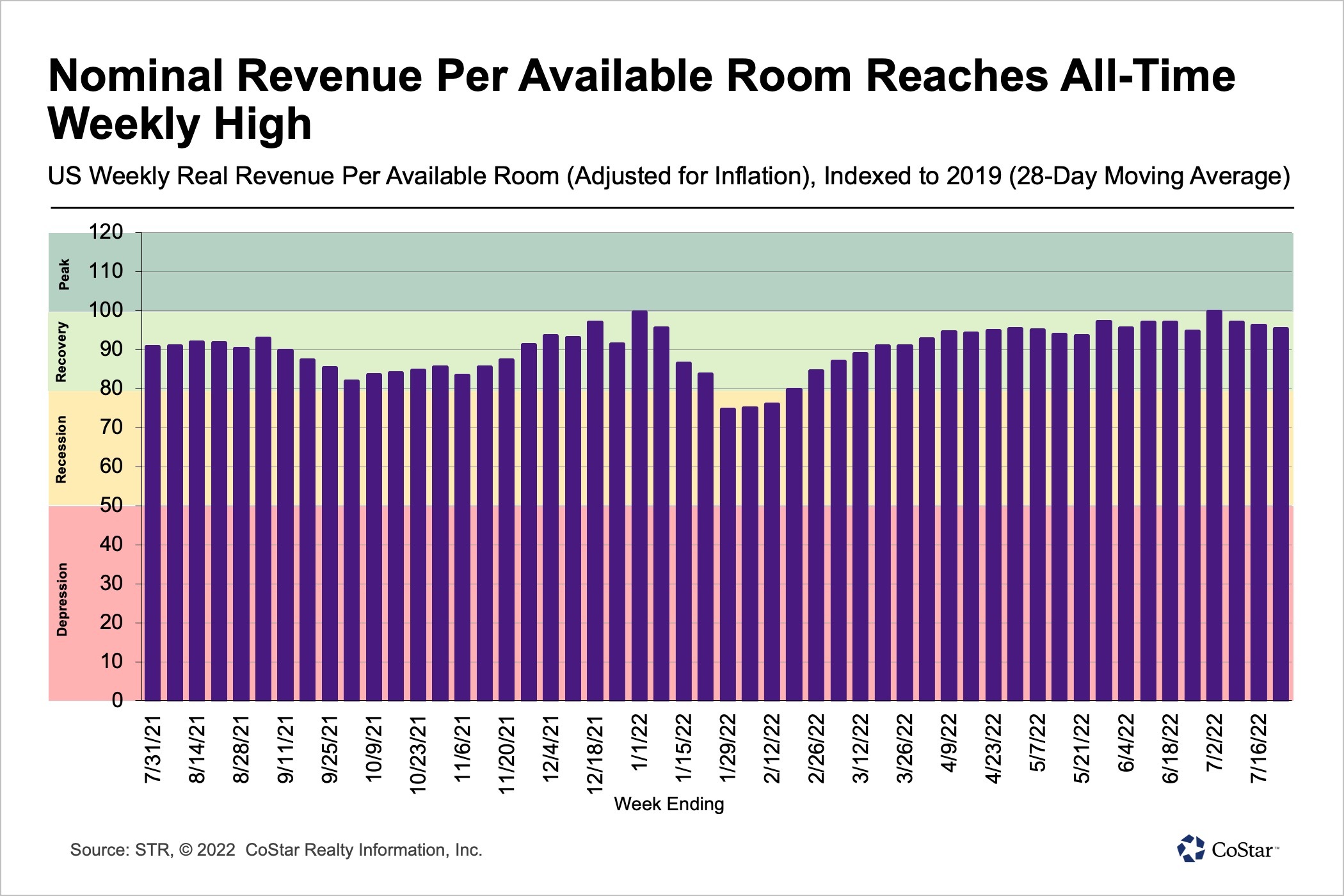

Nominal ADR was up 16% over the comparable week in 2019 and 11% year over year. At $115.59, nominal revenue per available room rose 2% week over week and 13% compared to 2021 to the highest weekly amount ever recorded by STR. Compared to 2019, weekly nominal RevPAR was 9% higher.

Adjusted for inflation, RevPAR was still the highest of the pandemic era, but ranked only 26th in weekly levels recorded since 2000.

Weekly real RevPAR surpassed 2019 levels in 75 of the 166 STR-defined markets. A week ago, 58 markets achieved that.

Over the past 28 days, 65 markets are at “peak” real RevPAR — above 2019 levels — and another 93 are in “recovery,” between 80% and 100% of 2019 levels.

A week prior, weekday demand — Monday to Wednesday — from the 25 largest markets led the resurgence in demand. For the week ending July 23, the growth was led by weekend demand outside of the top 25 markets.

Overall, weekend occupancy was 79%, the fifth highest of the pandemic era. Weekday occupancy was 73%, the highest of the pandemic era.

Weekday room demand was also the highest since March 2020. Weekday occupancy in the top 25 markets remained above 75% for a second consecutive week. Central business districts also had solid weekday occupancy at 74%, but lower than a week ago.

Market and Segment Highlights

All but six markets reported weekly nominal ADR above 2019 levels. Even more remarkable, real inflation-adjusted ADR was the ninth-highest since weekly benchmarking began. The highest was at the beginning of this year, a result of pent-up holiday celebrations. Three markets — Orange County (Anaheim), Oregon Area and San Diego — reported their highest real ADR of all time, and 104 markets had real ADR above 2019 for the comparable week.

Weekly hotel room demand was also the highest of the pandemic era in 21 U.S. markets, including Charlotte, Los Angeles, San Jose and Portland, Oregon. Additionally, six markets — mostly smaller ones such as Portland, Maine; but including Charlotte — set an all-time record for weekly demand.

While most markets did not surpass previous weekly highs, demand strength was widespread, leading to impressive occupancy levels.

Alaska once again led all markets with the highest weekly occupancy at 92%. It has been in the number one spot in five of the past seven weeks. Weekly occupancy was also well above 85% in San Diego, Oahu and Portland, Maine. Overall, 26 markets had weekly occupancy above 80%, with another 78 at between 70% and 80% occupancy. Combined, this was the highest number of markets with 70% occupancy or higher since summer 2019.

At 56%, New Orleans had the lowest weekly occupancy of any market. This is abnormally low for this market. In 2019 during the comparable week, occupancy was 67%; and in previous years it topped 70% for the week.

The top 25 markets also had a good week with occupancy at 75%, the third highest of the pandemic era. San Diego led the top 25 markets with 87% occupancy, but nearly all of the top 25 had occupancy above 70% for the week. Occupancy topped 80% for a second consecutive week in New York City, Boston, Denver, Orange County (Anaheim) and Seattle.

Group demand, a foundation for the top 25 markets, was also robust and above 1.8 million rooms for a second consecutive week among luxury and upper-upscale hotels.

At the property level, 42% of reporting hotels posting weekly occupancy above 80%. While strong, it still was below the percentage of hotels that reported that level of occupancy in the comparable week of 2019 (52%). Occupancy was below 60% in 22% of U.S. hotels, which is marginally better than a year ago.

Upscale and upper-midscale hotels continued to excel with both chain scales reporting their highest weekly demand ever. Upper midscale surpassed the record demand set just a week prior. One third of all rooms sold this week among branded hotels was in the upper-midscale chain scale, where demand was 6.3 million. Upscale hotels sold 4.8 million rooms in the week.

Isaac Collazo is VP Analytics at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.