U.S. office attendance is likely to stay constant for a while and as leases expire and companies search for new space they plan to prioritize buildings that make it easy to get to the office.

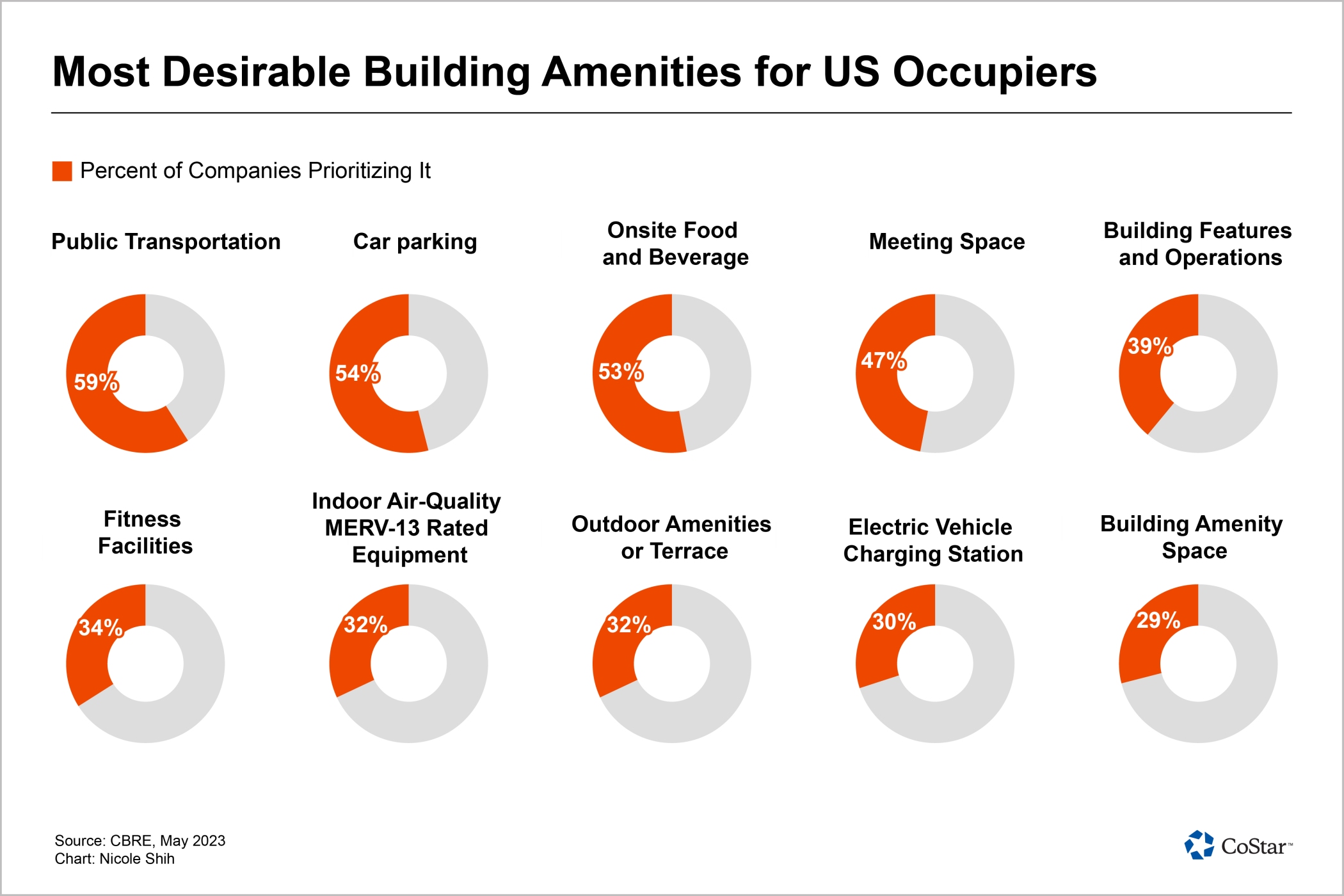

Buildings that provide easy commutes and parking were the top two amenities favored by companies surveyed for Dallas-based CBRE's latest office occupier sentiment report.

About 65% of companies are requiring in-office work at least some of the time, more than double the amount making the requirement last year, according to the survey that was released last week of 207 corporate real estate executives in the United States.

Even with an in-office work requirement, most surveyed executives, or 60%, said their office use has settled at a steady state, meaning firms are accepting a "less-than-full utilization as the new normal," CBRE said.

That 60% is up from 43% last year and represents what CBRE calls "a long-term steady state" that is lower than before the pandemic. About 38% of companies expect their office attendance to increase in the future.

This new normal in the workplace is making way for executives to make some big decisions on their office portfolios, with more than half of those surveyed planning to trim unoccupied space as leases come up for renewal. Most of those surveyed also plan to relocate to what they consider to be better quality space with walkable amenities and flexible lease terms.

The survey's results come as the future of office space in the United States has remained murky for even the top real estate executives as hybrid work upends the way a workplace had once been utilized. The office sector for CBRE's business in the United States has yet to return to pre-pandemic levels, compared with its Asia-Pacific business, according to CBRE's earnings report released last month. This lack of recovery has CBRE "much less dependent" on office properties, CBRE CEO Bob Sulentic told investors during the brokerage firm's earnings call last month.

Shrinking Footprints

More than half of the companies surveyed by CBRE expect their office portfolios to get smaller over the next three years with companies shrinking office footprints to match office attendance patterns.

“Real estate evolves to accommodate changes in human behavior, and we’re seeing that as the office market adapts to hybrid work,” said Manish Kashyap, CBRE's global president of advisory and transaction services, in a statement. “This means greater flexibility in lease terms, more occupiers gravitating to higher quality office space, and an increase in adaptive reuse of obsolete buildings."

In seeking to reflect employee office usage, real estate executives are looking for landlords to help with providing access to shared amenities, such as conferencing facilities, flexible office space and tenant lounges, to help them expand capacity when needed, but keep their real estate footprint relatively small. Another 34% of executives responding to the survey want to have access to space that can be quickly built out and furnished for quick occupancy when they need more space.

About 39% of respondents are interested in finding ways to match their real estate costs to office attendance patterns, such as paying less rent until they reach a steady-state threshold of attendance. That attendance threshold, if not already met, could be coming soon, with companies such as AT&T recently telling some of its employees to return to the office or quit after defining key U.S. offices in which to concentrate its efforts as it seeks to trim excess real estate from its portfolio.

In reshaping real estate portfolios, executives reported using a broad range of strategies, such as allowing leases to expire, renewing office space — even if it's for less space — or relocating to higher-end office space. About 40% of real estate executives responding to the survey say they are revisiting their existing lease terms now that occupiers have more negotiating leverage.

Easy Access

Some of the most sought-after amenities in a building by would-be tenants isn't located on the property itself, rather it's the ease of commute and conveniences surrounding the office building, executives told CBRE.

About 59% of companies favor buildings with easy access to public transportation, with commute times noted as being a top factor for workers in weighing future job opportunities — only second to salary, according to CBRE's research. Along with easy access, most real estate executives want to make it easy for workers to stay close to the office with on-site food and beverage options.

So, how important are these amenities to the future of the office sector? It could depend on what industry the respondent is rooted in, according to the survey, with vast differences of in-office work requirements between two of the largest U.S. industries: Technology and finance and professional services.

Finance and professional services firms have more in-office work mandates, while the tech industry has offered more workplace flexibility, pushing some companies such as Salesforce and Google to put office space they no longer need on the sublease market.

Julie Whelan, CBRE global head of occupier research, said in the statement that "top executives at finance companies are more focused on office attendance, especially amid economic uncertainty, than are their counterparts at tech companies.”