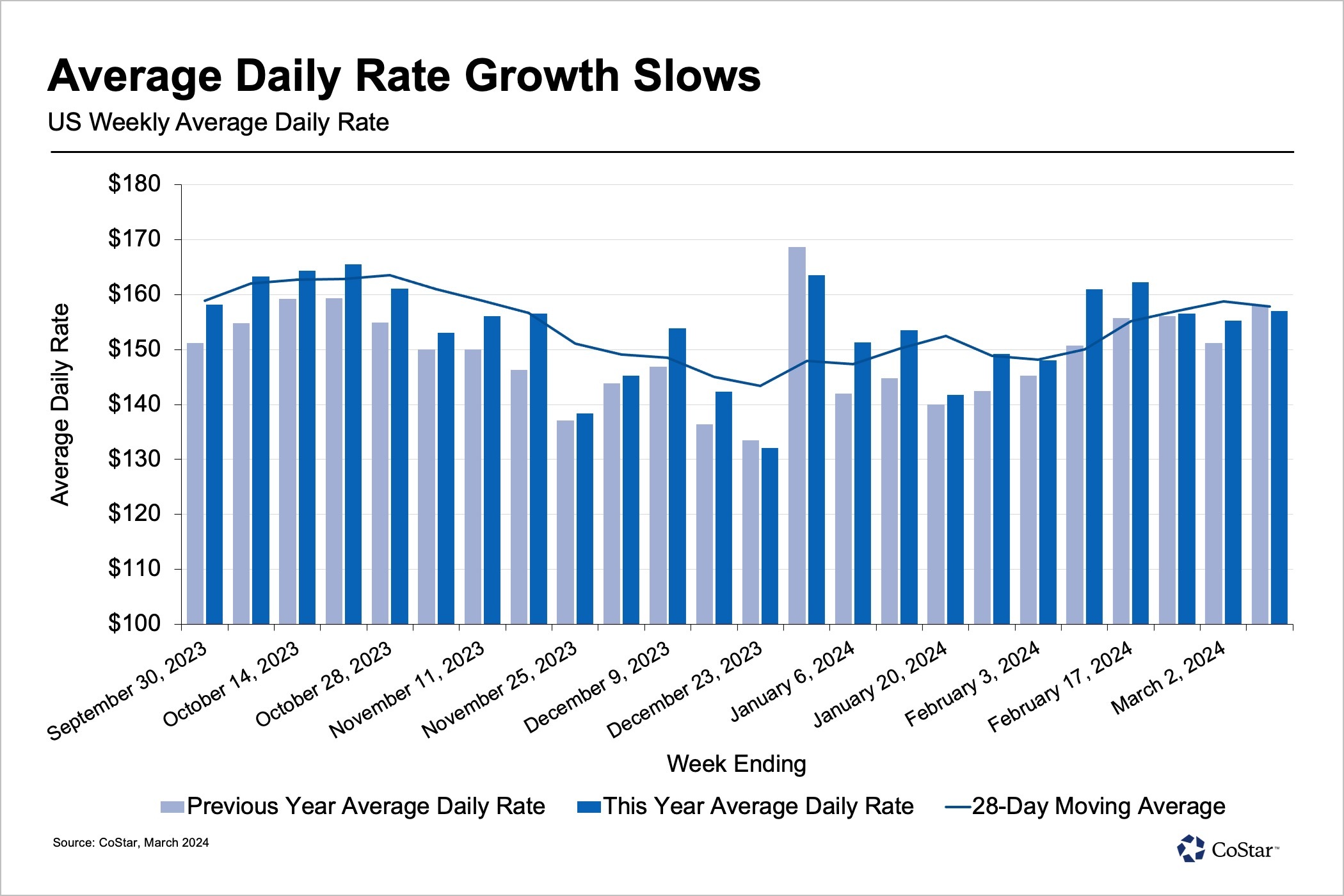

For the first time this year, weekly U.S. hotel industry rates were lower than a year ago, resulting in lower revenue per available room for the third time in 2024.

Las Vegas again played a big role in the latest weekly results, but this time the impact was negative. Due to a shift in the convention calendar in the city, RevPAR was down 30.6% year over year.

Hotel demand from group travelers continues to be a bright spot. Group demand at luxury and upper-upscale hotels, defined as bookings of 10 or more rooms, increased for the 10th straight week in the U.S., including in Las Vegas. The metric was up 7.4% year over year and just 1% below 2019 levels.

Average daily rates from group business, which had shown healthy growth of 5% or more over the past four weeks, declined by less than a percentage point. Nearly all of the growth in group demand occurred in the top 25 markets, led by Minneapolis, St. Louis and Denver.

In the coming weeks, spring break, the total solar eclipse and college basketball tournaments are expected to drive higher demand for U.S. hotels.

US Performance

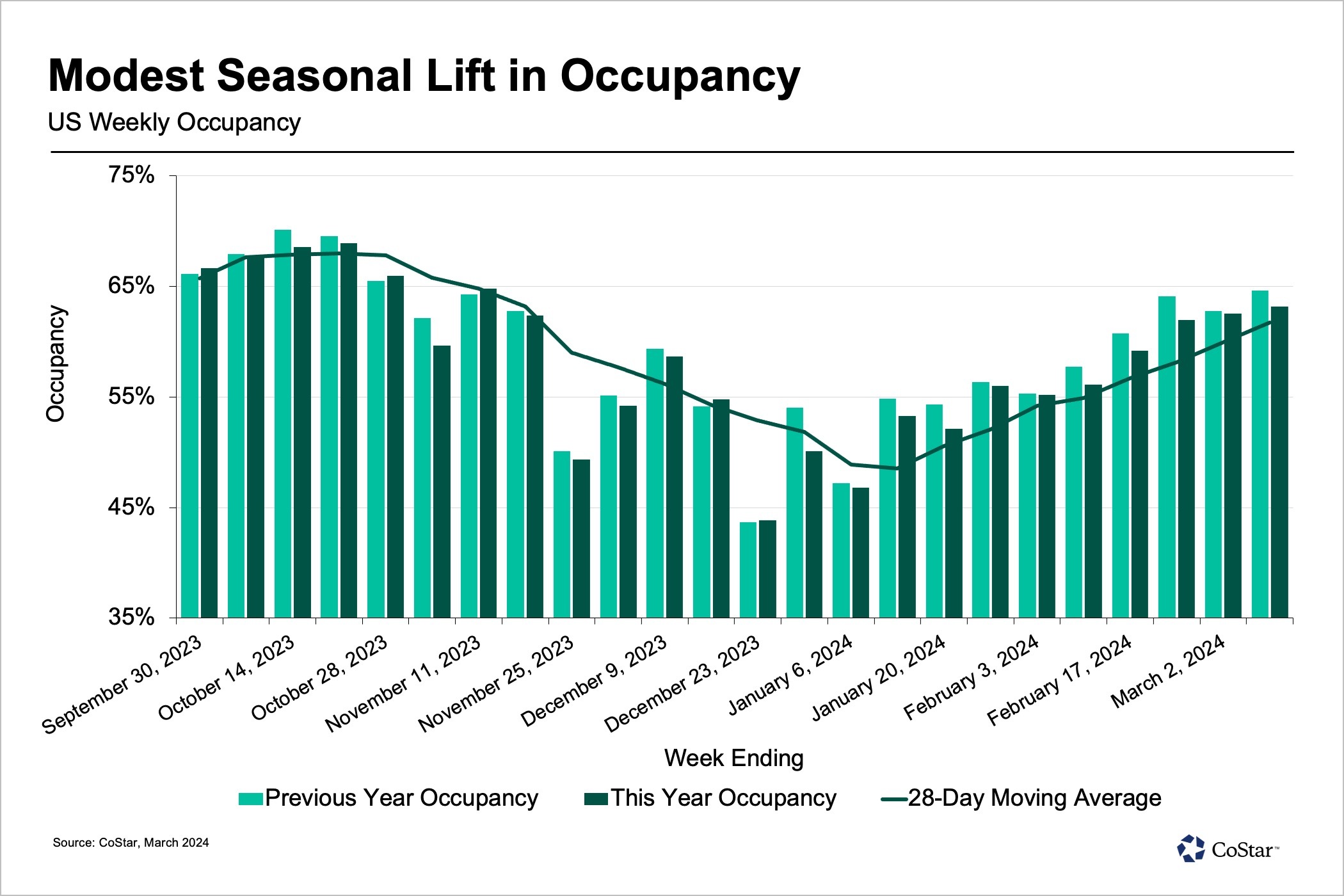

Weekly U.S. hotel RevPAR fell 2.8% year over year due to lower occupancy. Economy hotels contributed the most to the total demand loss.

Hotel performance was relatively stronger during the weekdays of Monday to Wednesday, indicating continued strength in business as well as group travel.

Among the top 25 markets, Minneapolis hotels led the nation with year-over-year RevPAR growth of 45.1% as it hosted the Big Ten Women’s Basketball Tournament. St. Louis and Washington, D.C., also posted double-digit RevPAR growth.

Across the next 25 largest markets, Baltimore, San Antonio, Sacramento, and San Jose had great weeks with RevPAR up 10% or more year over year, lifted by both ADR and occupancy gains. Phoenix had the nation’s highest occupancy at 85.6%, followed by eight Florida markets where occupancy ranged from 81.6% in Fort Myers to 84.1% in Fort Lauderdale.

Global Performance

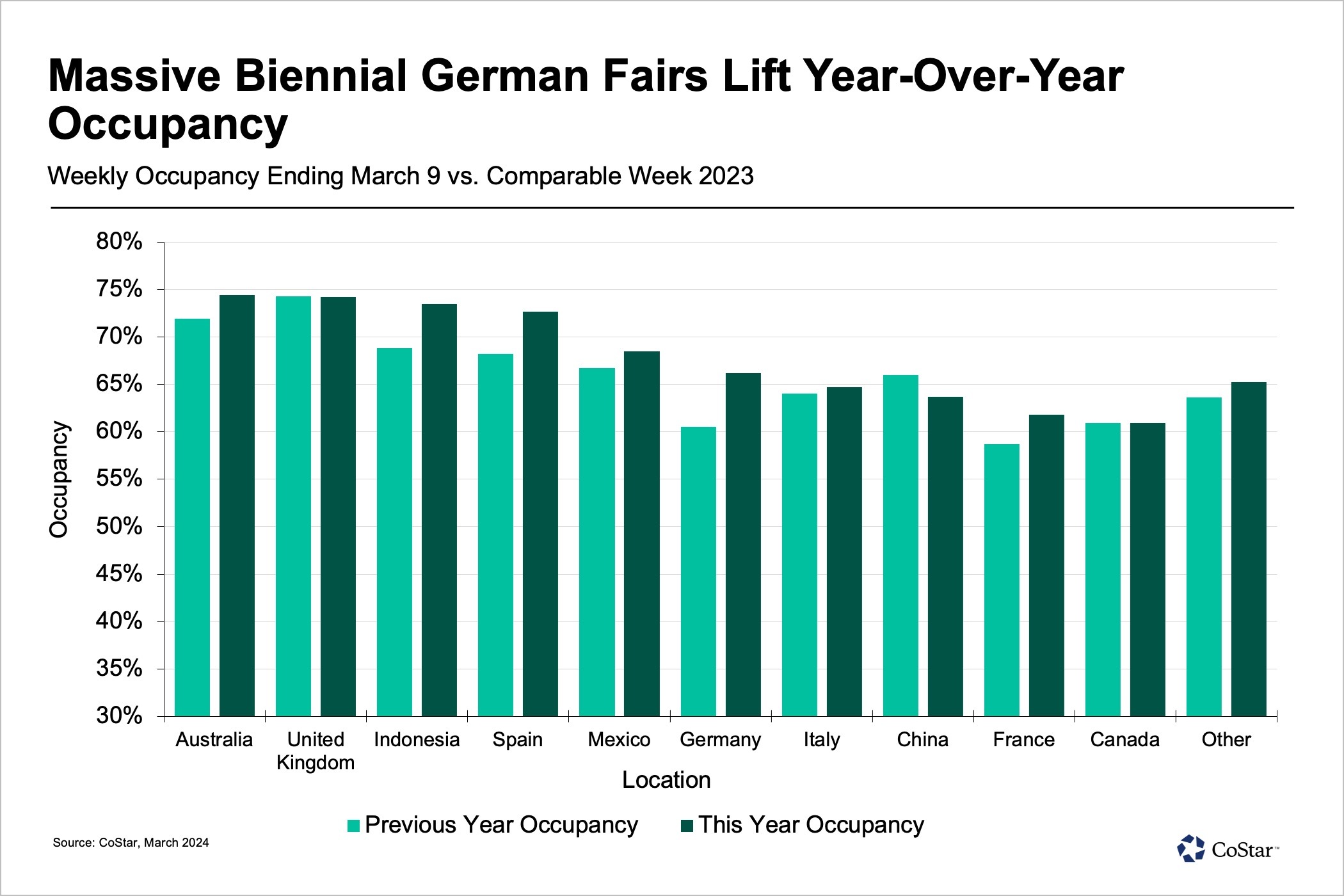

Among the countries with the largest hotel supply in the world, Germany led with the highest RevPAR growth, up 27.9%. Occupancy in Germany increased 5.7 percentage points to 66.2%, with ADR up 16.8%. Performance was boosted by large trade fairs across the country, particularly biennial events in Cologne and Frankfurt.

Indonesia hotel occupancy has surpassed 2019 levels in all but one week this year and has been above last year’s levels in all but two weeks. From the beginning of the year, occupancy has grown 13.2 percentage points.

Taylor Swift’s performances in Singapore concluded on Saturday, resulting in impressive ADR growth of 32.1% and an 11.2-percentage-point rise in occupancy. RevPAR grew 50%, which was the largest increase of the past 25 weeks. Occupancy was 88.7%, the highest since mid-June 2023.

Isaac Collazo is vice president of analytics at STR. Chris Klauda is senior director of market insights at STR. William Anns is a research analyst at STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.