CoStar Risk Analytics 团队由商业房地产信用风险专家组成,成员包括经验丰富的博士、注册分析金融师以及注册会计师,他们曾就职于各种规模的银行、监管机构、人寿保险公司以及投资公司。

凭借数十年经验,业内最全面的商业房地产数据库以及久经验证的 COMPASS 信用违约模型,CoStar Risk Analytics 助您更快速地深入剖析市场、楼宇和贷款。

CoStar for Lenders

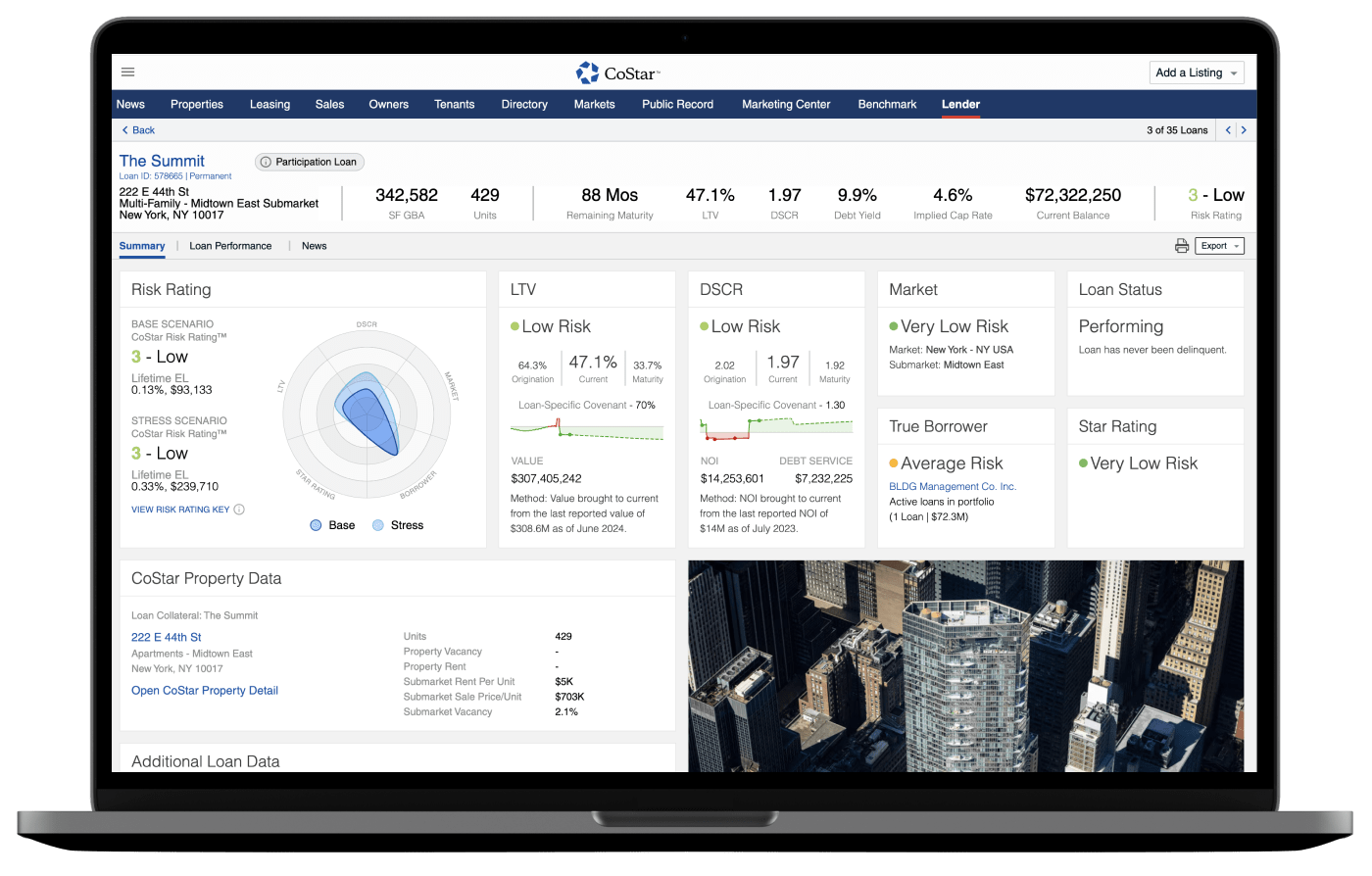

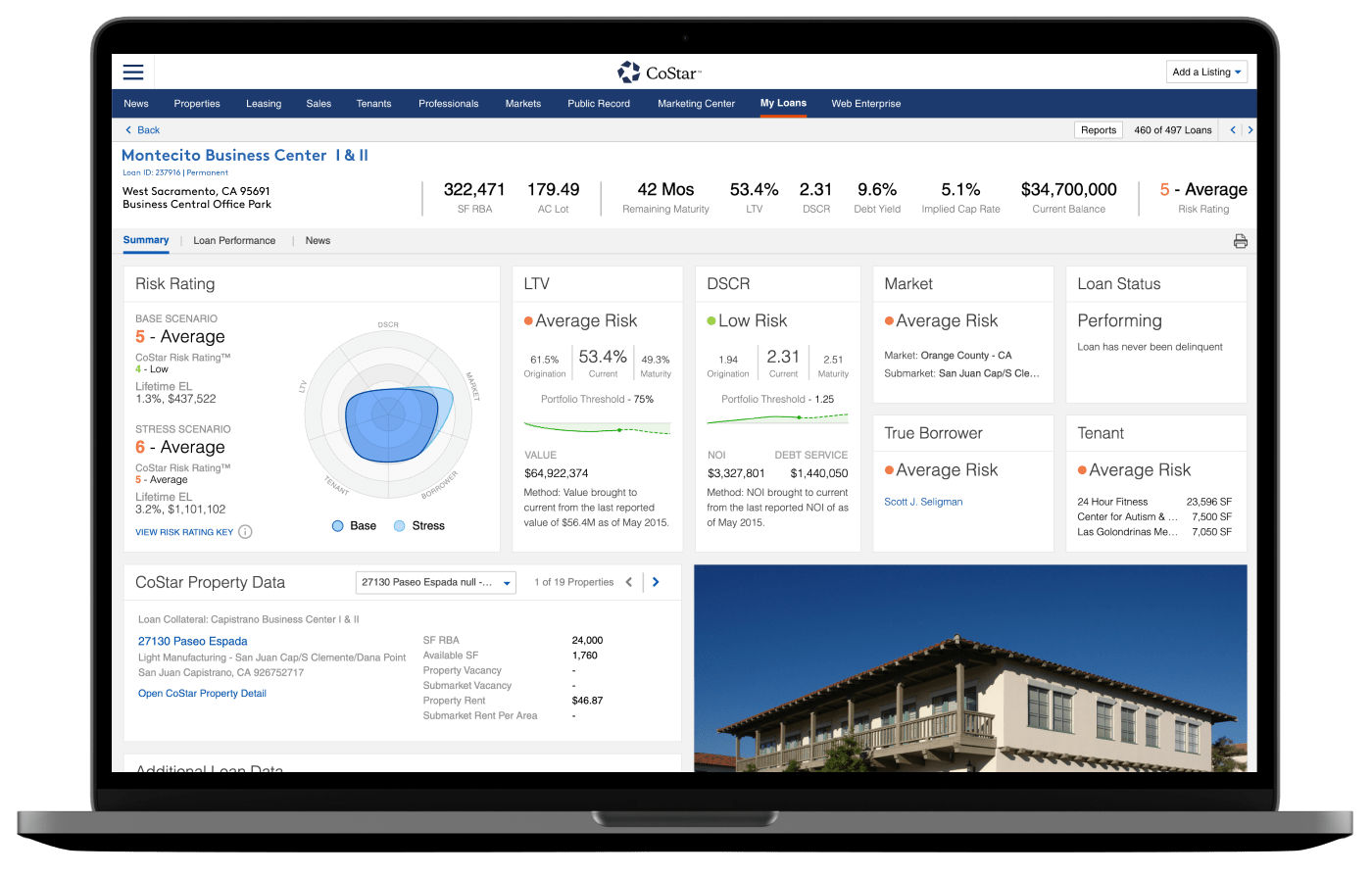

将您的贷款组合与 CoStar 业内领先的物业信息、市场分析及 COMPASS 信用违约模型相匹配,有助于您更快做出明智的贷款决策。

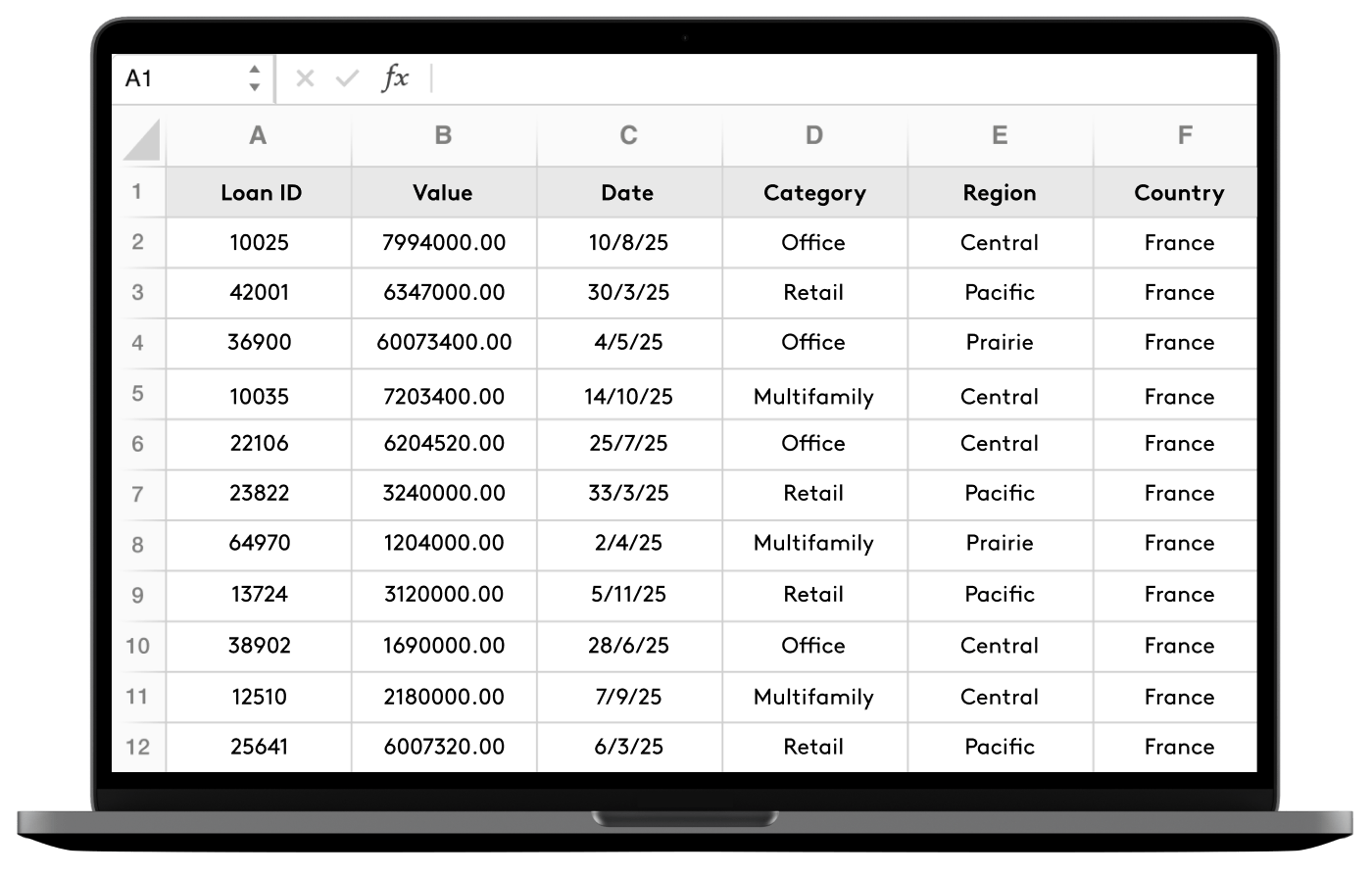

您的贷款组合

经审查后上传至 CoStar 的安全数据库。

结合 CoStar 的强大实力

730 万处

商业

物业

2000 万条

租售

对比数据

830 万份

租户

资料

1.7 万份

次级市场

预测报告

18 年

COMPASS 信用

违约模型

简化风险管理。

一体化数据、分析和信用违约模型。

为什么 CoStar for Lenders 是您的理想选择

提高运营效率

确保透明度,满足监管要求,让顶尖人才专注于分析工作。

赢得更多交易

全天候访问 CoStar 数据和分析,更快、更好地做出贷款发放和组合决策。

从容管理风险

及时获取整个贷款组合的 LTV 和 DSCR,并通过物业数据最大限度提高其绩效。

数据完整性和安全性

采用先进技术,通过完全托管的网络解决方案实现数据清理,该解决方案旨在满足所有行业标准的安全要求,并提供所有相关审计报告。

CMBS 优势

综合性 CMBS 投资者平台,整合了 INTEX CMBS 数据、Costar 业内领先的 CRE 数据、市场分析以及 COMPASS 信用违约模型,所有数据均直接对应您的每笔 CMBS 交易、贷款以及抵押物业。

19.1 万

CMBS 物业

130 万

同类物业

120 万

销售对比数据

200 万

租赁对比数据

50 万

租户

借助 CMBS 投资者平台,您将得到:

- 强大的数据可视化功能,并搭配可配置看板,用于生成结合当前风险和预测风险评估的高管报告。

- 管理报告,包括压力测试、NOI 以及物业价值预测等。

- 专属贷款报告,包括深入的信用分析、全面的贷款风险以及准确的现金流预测。

- Compass 违约模型生成的损失预测和价格收益分析,该模型集成了第三方债券现金流模型。

- 轻松设置,并最大程度降低 IT 资源需求。

了解 CoStar 如何助力您的业务发展。

请致电 888-226-7404 联系我们,或提交此表申请产品演示。