The challenges of 2020 for the hospitality industry heavily impacted global hotel performance levels as revenue per available room, a top performance indicator, fell by 55.3% year over year, according to total room inventory data from CoStar's hospitality analytics firm STR assuming all hotels in the market are open. Likewise, global hotel development, which has implications for future hotel supply that will in turn weigh on performance, also took a hit from the pandemic.

This article will explore the global impact on pipeline projects in comparison to 2019, focusing on factors such as construction delays, project abandonments and expectations for the future.

According to pipeline data as at December 2019, there were 3,867 hotels and 603,037 rooms set to open in 2020. Of these, 322,561 rooms came to fruition, which equates to a 53% completion rate, as of February 2021. This is a substantial drop compared to 2019. Of the projects in the hotel pipeline as of December 2018, 77% had materialized by February 2020.

There were 9.7% more rooms set to open in 2020 compared to 2019, and therefore more room for delays. However, we can’t ignore the impact of the pandemic on these numbers.

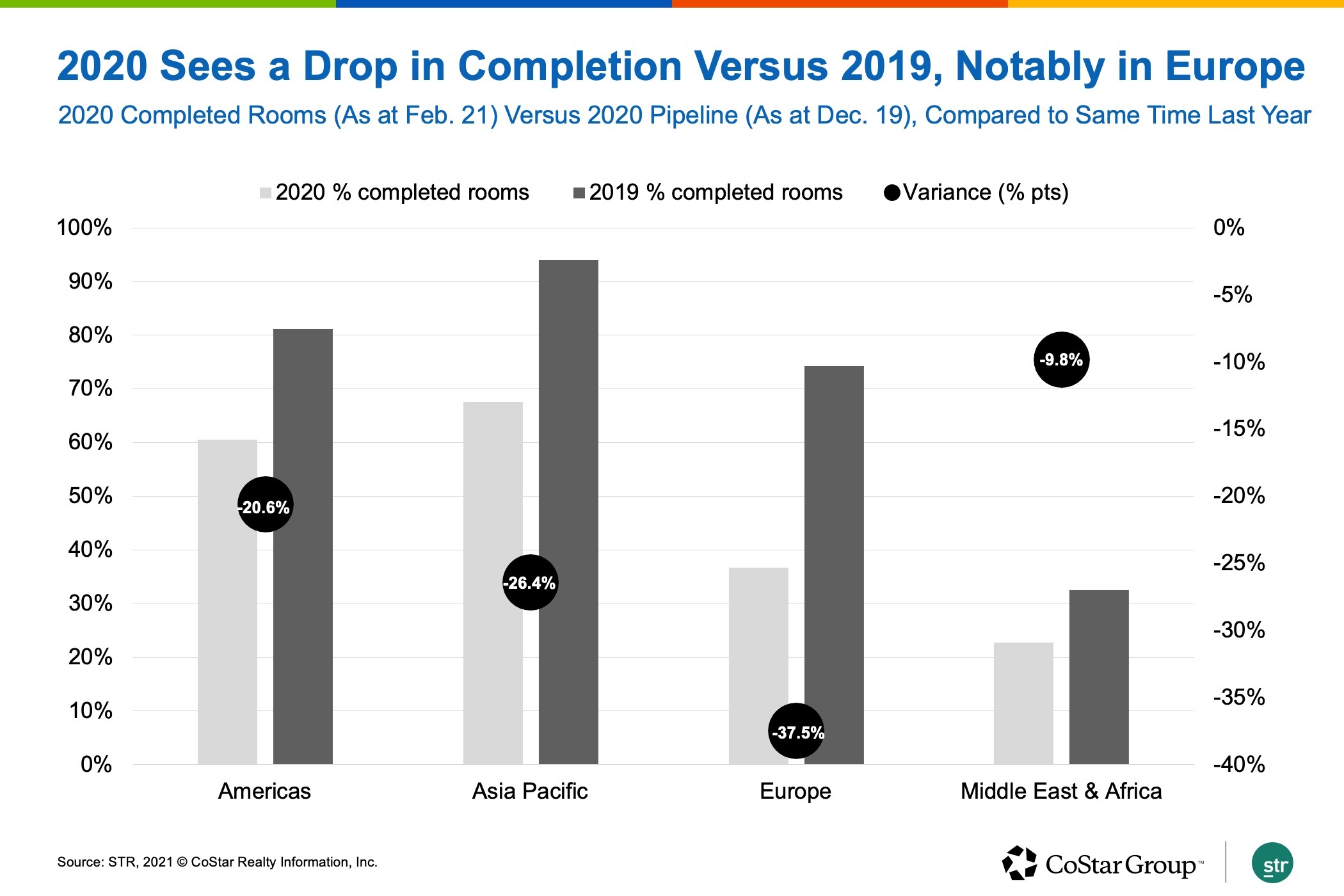

A lower completion rate has been prevalent across all global regions.

The greatest year-over-year drop in hotel project completion rate was felt in Europe, which was down 37.5 percentage points from 2019 to 2020. This is aligned with performance levels, as hotels in Europe also took the biggest hit from a RevPAR perspective in 2020, driven by high COVID-19 case levels and widespread lockdowns.

The Middle East and Africa region, however, posted just a 9.8-percentage-point year-over-year decline in hotel project completion rate. This region did come from a lower base, with a 33% completion rate in 2019, compared to a 77% global completion rate.

The highest hotel project completion rate for the year was 68% in the Asia-Pacific region. This was due to countries such as China, which had a 96% completion rate with 590 completed hotel projects consisting of 86,199 rooms in 2020. In Japan, 140 hotels and 26,664 rooms were completed — a rate of 86%. That was likely driven by a supply ramp-up ahead of the Tokyo Olympics.

Delayed or Canceled?

The question to explore here is what happened to these projects? Were they merely delayed or were the projects abandoned entirely?

Globally, there were 1,505 projects and 189,662 rooms abandoned between December 2019 and February 2021, which is only a marginal increase compared to a year prior, when 1,468 projects were abandoned.

Deferred projects, for which activity has stopped but may resume within the next 12 months, came in at 1,662 hotels and 244,797 rooms for the year. This is a substantial 72% increase in deferred rooms compared to the previous year. In absolute terms, the largest uptick in rooms abandoned or delayed was experienced in Germany (27,288), the United Kingdom (38,206) and China (79,601).

The pandemic's financial impact on companies across the globe has likely driven many of these abandonments and deferrals.

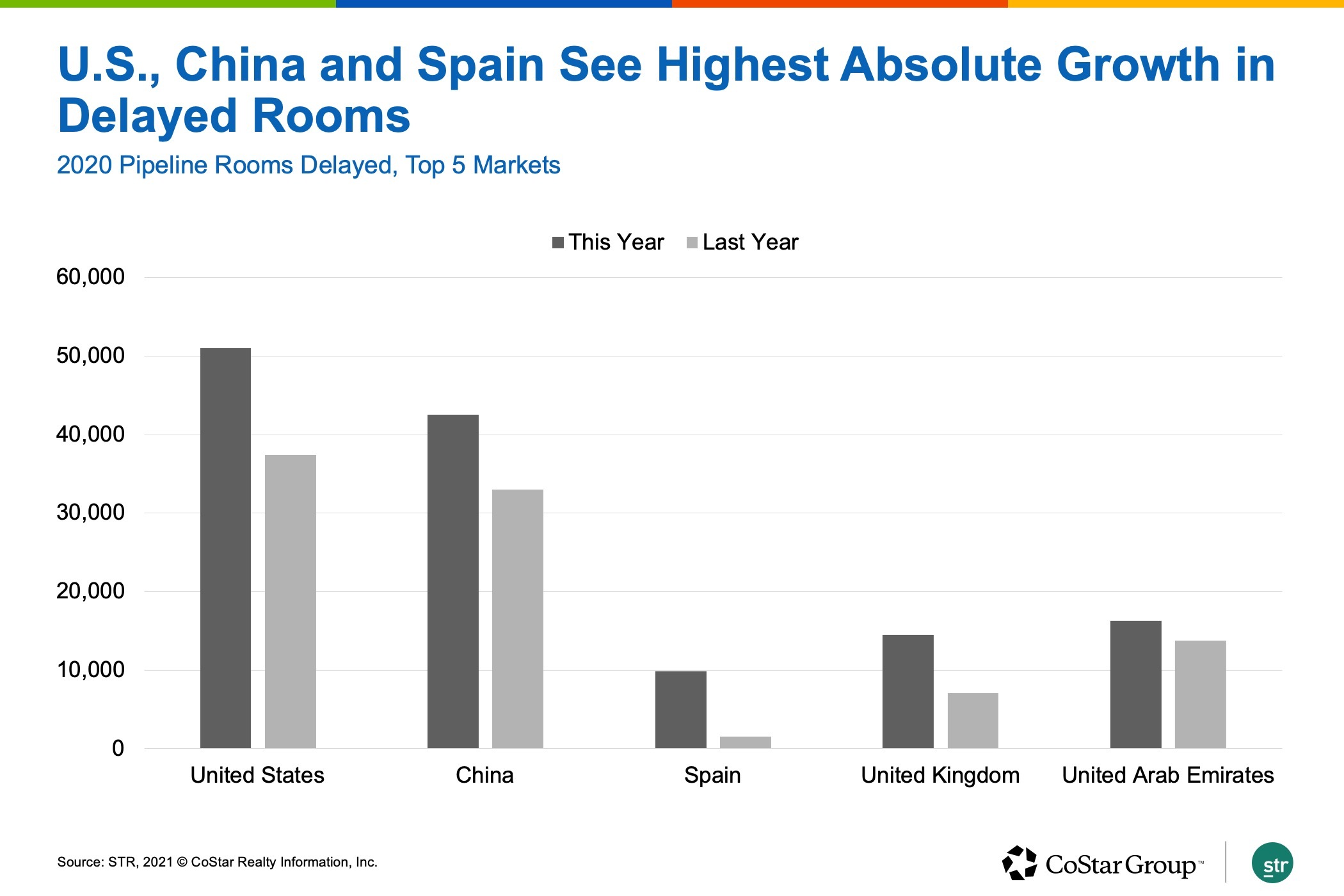

For projects set to open in 2020, substantial delays also took place. In total, 1,694 projects and 269,307 rooms were delayed from 2020, with 79% of these rooms moving into 2021. Delayed rooms were up by 35% compared to the same data in the previous year.

The United States, China and Spain posted the highest year-over-year absolute increase in delayed hotel rooms. Factors that could have driven this include construction delays due to lockdowns as well as hoteliers choosing to delay opening until there was demand in the market to fill hotels.

Expectations for 2021

Looking ahead, it is likely that there will be a continued uptick in delay rates in 2021 across some regions. STR’s forecasts, created in partnership with Tourism Economics, estimate that the portion of rooms set to open in 2021 will be delayed at a similar rate to 2020. The same expectation holds for the rate of hotel projects that are abandoned or deferred.

Projects in earlier stages of development (planning and final planning) have a higher probability of abandonment compared to those that are already in construction.

These assumptions mean supply growth expectations have been downgraded for a majority of markets globally. Lower supply means more opportunity for occupancy recovery and less competition in the market, which means less pressure on rates. Therefore, this drop in supply should help markets to recover more quickly.

However, this depends significantly on the region. For most European markets, February 2021 forecasts project higher pipeline delay rates compared to the November 2020 forecast. It was the reverse for Asia-Pacific markets, where the rate of delays has reduced in the past year due in part to activity in China, which reported the lowest delay rates driven by strong performance in the second half of 2020.

There are 4,010 hotels and 611,193 rooms slated to open in 2021, as of December 2020. This is 143 more projects than were set to open in 2020, which is in part driven by pandemic-related delays. The U.S., China and Germany lead the way, indicating there is still confidence in hospitality for markets significantly impacted by the pandemic.

What’s clear to see is that performance and development were both impacted in 2020. Completion rates came in quite a bit lower than the previous year and there was a high proportion of projects that were deferred and abandoned. While a large proportion of projects were delayed, the majority of these fell into 2021. In markets that were hit particularly hard by the pandemic, generally there was a greater chance of an impact on development, and we expect this to continue into the coming year.

Natalie Weisz is a director of research and development and analysis, based in London, at CoStar hospitality analytics firm STR.

This article represents an interpretation of data collected by CoStar's hospitality analytics firm, STR. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.