(Updated on April 21 to correct Dawna Comeaux's title in the eighth paragraph.)

The COVID-19 pandemic was a shock to the system that led to a number of layoffs across the hotel industry. But as demand starts to return and occupancy increases, hoteliers are finding ways to bring back staff.

Del Ross, chief revenue officer of Hotel Effectiveness, said "there are certainly a lot of material changes that have happened and are going to happen to labor" in U.S. hotels.

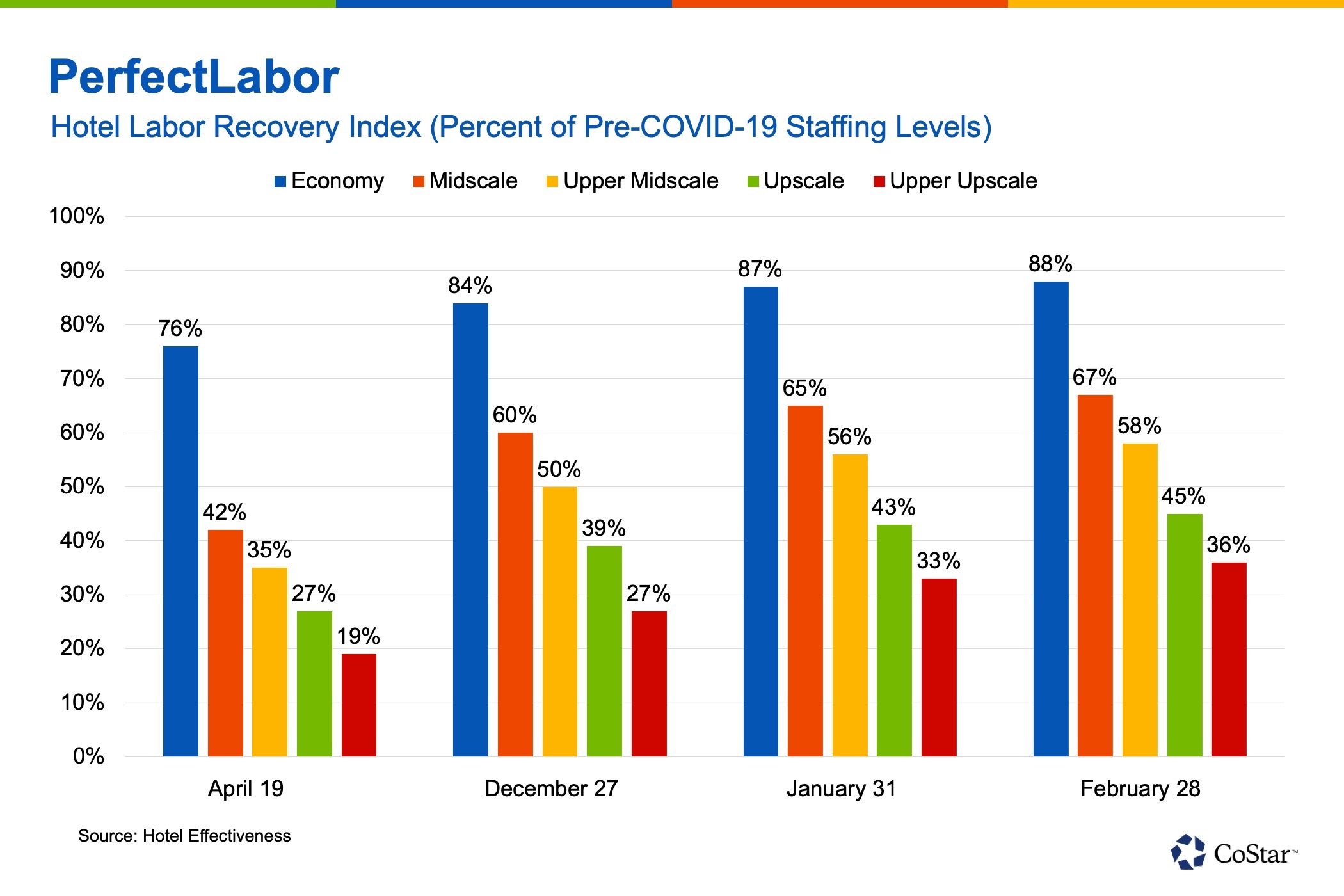

Most hotel jobs were eliminated during the worst part of the pandemic recession, and the U.S. hotel industry was down to a quarter of the jobs it had in March 2020 by mid-April of that year, he said.

"To this day, the hotel industry job losses represent the majority of the long-term job loss gap in the U.S. unemployment figures," he said.

While the hotel industry is one of the hardest-hit by the pandemic, 50% of pre-pandemic jobs had returned as of February 2021, Ross said.

He added that the job loss impact was not felt evenly across markets and hotel sectors.

“Some kinds of hotels and some markets actually did OK,” he said. “Economy hotels in certain leisure markets tended to actually do OK. Extended stay tended to do OK, and they were able to keep their people. But city center, full-service, conference hotels [were] devastated — cut down to the bone because they just didn’t have any business.”

Dawna Comeaux, executive vice president and chief operating officer at Spire Hospitality, said her company had to make the tough decision to reduce its workforce by 75% at the peak of the pandemic.

Executives at the Irving, Texas-based hotel management company talked with general managers to figure out which team members would prove to be the most valuable in the current situation and had to stay on board. These team members were people who could perform multiple tasks, adapt quickly and work across multiple departments, she said.

“For the last year we’ve had sales managers who are making sales calls while also working at the front desk and inspecting rooms,” she said. “We’ve had maintenance folks or room attendants who might be performing routine maintenance duties but also might be doing laundry or helping in the kitchen.”

After that initial wave of layoffs, Spire tried to maintain contact with as many team members as possible to keep them informed about what was going on at the hotel and in the greater industry, Comeaux said.

“That way we were able to assist them if they needed help with unemployment or if there were other state assistance programs out there they might not be aware of that we could plug them into," she said.

Rehiring

Last summer, Spire was able to start bringing back team members as it had some hotels in resort locations where “we were able to get a piece of group or project business that would warrant some additional staffing," Comeaux said.

As of March 30, 2021, Spire was at 50% of its pre-pandemic staffing levels, she said.

“We wanted to be extremely thoughtful in making sure we were hiring the right number of people in the right number of positions for the long term,” she said. “We didn’t want to hire people just for the season and then just kind of whiplash lay them off again.”

The company did this by layering in team members for the short-term demand and the long-term demand that could be projected out, she said.

The hotel industry has experienced a recent increase in occupancy, and that trend is going to continue throughout the summer, Ross said.

“But as guests return, we need workers, and hotels are already scrambling to fill jobs. They are finding … the veteran hotel employees that had been let go last year, they didn’t wait around. They got other jobs," he said.

The industry now has to recruit from a labor pool of inexperienced workers who don't come from the industry, "so you have a double whammy of having to attract people to an industry they've never served before and you have to onboard and train them because they don't know the job," he said.

Move to a Dynamic Staffing Model

While the ramp-up and job recruiting process is difficult, Ross said "it's a good problem to have compared to collapsing occupancy," and there are ways hoteliers can maximize hiring and retention efforts.

Dropping the static staffing model and moving to a more dynamic one could help, he said.

Ross said 85% of hotels in North America have a static staffing model in which weekdays and weekends require a different amount of staff.

“They do that week in, week out. Sometimes they have a seasonal impact as well, but in general, that’s the way they build their model, which is fine when you have really stable markets … but with a combination of very volatile occupancy that’s projected to continue the rest of the year … you can’t use last month’s schedule anymore. It doesn’t work," he said.

Ross said while occupancy is up, room rates are still 20% or lower than they were pre-pandemic, which is where a dynamic staffing model could help.

A dynamic staffing model entails using property management system data and applying productivity standards such as how long it takes to clean a room or check in a guest to determine how many hours of labor is needed for every position at the hotel, he said.

“Adopting a dynamic staffing model is going to help a lot because what it’s going to do for most hotels is let them know they actually don’t need as many hours as they think they do, and that could mean they need to hire fewer people quickly than they thought they did," he said.

“That could be a big savings rate that could help alleviate 20% of the staffing pressure and the resulting cost just by switching to a dynamic staffing model,” he added.

Cross-Training Employees

Job sharing could also help hotels with staffing for more demand and higher occupancy, he said.

“Hotels have always encouraged [cross-training] the more tenured people, but most hotel employees don’t stay in a position even a year," he said. "People just turn over like crazy. So you didn’t really get the chance to cross-train them."

Cross-training employees is no longer a luxury, he said. Hoteliers need the flexibility within their staffing models.

“We need people to be able to do multiple jobs because not doing that means you have to hire more people," he said. "If I have somebody who can work the front desk, turn over rooms and work at the breakfast bar, I have a lot more flexibility with staff and I can fill up a job with three different roles instead of having to hire three people part- or full-time to fill those three roles. It's really a flexibility you have to have now."

Labor per Occupied Room

Hotel Effectiveness tracks labor hours per occupied room for a database of 5,000 hotels in the U.S., which shows that the labor intensity of serving guests has decreased during the pandemic.

Pre-pandemic, the average hotel logged a little over two hours of labor for every occupied room, but that's dropped to 1.5 hours over the course of the pandemic, which is a good thing, Ross said.

However, hoteliers shouldn't count on that decrease to be sustained as occupancy returns to help offset lower rates, he said.

"That's a false hope," he said, "[We] don't want to have that because the reason labor is reduced now is because there are few food and beverage jobs filled."

Ross said those food and beverage jobs will return, and they will be back for the most part this summer.

Hotels tracked by Hotel Effectiveness, on average, are saving 20 minutes of labor in food and beverage and 10 minutes in cleaning because housekeepers aren't going into rooms each day, he said, noting that also is likely to change soon.

"That's going to add back labor, and if hotels aren't anticipating that increase in labor intensity, they could really be hit hard with a bad economic surprise," Ross said. "[Hotel Effectiveness] is trying to get the word out to be prepared for this half hour of extra labor per occupied room to come back over the next six months."

UK Hospitality Sector Hit Hard

With strict lockdowns and hotels still closed while some pubs and retail open up in the United Kingdom, the hospitality labor force has been hit disproportionately hard by the pandemic.

Figures from The Office of National Statistics Data show that the number of paid employees in the U.K. dropped by 56,000 between December 2020 and February 2021. The total number of people in paid employment fell by 813,000 between March 2020 and March 2021.

A news release from UKHospitality states that the U.K.'s hospitality industry has 355,000 fewer employees than it did in 2020, which accounts for 43% of the national total.

Restrictions in the U.K. for hotels, museums, performances and sporting events are scheduled to be lifted by the government on June 21.

Kate Nicholls, CEO of UKHospitality, said in the release that "hospitality business’ ability to reopen will remain massively hampered until the government can deliver on its commitment to dropping legal requirement of COVID restrictions and measures on [June 21]."

"Even then, with so many companies facing rent debts and business rates bills, after more than a year with little trading, many companies — and thousands more jobs — will be in jeopardy unless further support is forthcoming," she said. “Should the [June 21] date lapse, employer furlough contributions could also tip businesses over the edge. Additional support for jobs, coupled with longer-term plans for training, are vital."

London-based RBH Hospitality Management was one of many companies that had to let go of employees, but layoffs weren't the immediate reaction, Martin MacPhail, group director of human resources, said via email.

"In March 2020, at the early stages of the pandemic and before the government announced a national lockdown and subsequently the Coronavirus Job Retention Scheme, RBH started planning for a major downturn in business," he said. "Our priorities were to preserve the hotels for the owners and investors; preserve the future of the corporate business RBH Hospitality Management Ltd; and to preserve employment."

Since the company has its "established values of integrity and care at the forefront of every decision we make," RBH first looked to employees to take voluntary reduction in hours, he said.

"Temporary layoffs were one of the last options, per our employment contracts," MacPhail said. "Thankfully, careful planning and no knee-jerk reactions bought some time and the CJRS was announced. As of March 23, 2020, there were no job losses, no layoffs. We utilized the furlough scheme."

RBH introduced "flexible furlough" at the corporate level, allowing everyone to work in some capacity, he said.

"Similarly we have endeavored to get as many of the hotel team working. Due to government guidelines, most of the hotels have had to remain closed for a number of months, with only a few hotels remaining open for key workers. As we gear up for opening and the summer of 2021, the teams at the hotels all have a reinduction course in order to reintegrate them back into the business. We have also carefully planned staffing levels required for reopening," he said.