Amazon, the world's biggest retailer, roiled the real estate world earlier this year when it said it would slow its pace of warehouse leasing and begin to sublet some of the tens of millions of square feet it had committed to as part of its pandemic-era expansion. But the fallout may not be as dire as some initially feared.

The pullback could say more about a strategic shift than a retreat from real estate. The company has spent billions of dollars over the past couple of years to buy undeveloped land as well as properties for conversion to logistics centers, signaling it may have designs on leasing less and owning more in coming years.

The company, which had more than $34 billion in cash on its balance sheet at the end of the first quarter, spent at least $2.3 billion to acquire dozens of properties totaling more than 5,000 acres since early 2020, CoStar data shows. Included in that tally are nearly 400 acres it has bought over the past three months, a period in which Amazon has scrapped or postponed large office and industrial projects across the nation and revealed plans to shrink its U.S. footprint of delivery and fulfillment centers by millions of square feet.

"In a perfect world, Amazon wants to control its own real estate, especially the specialized and high-throughput facilities like final-mile delivery centers," Paul Jones, managing director at Bridge Logistics Properties, a subsidiary of Utah-based Bridge Investment Group, told CoStar News.

Amazon's leasing slowdown comes as consumer confidence has slipped, inflation has climbed and interest rates are on the rise. Its shares were down about 25% from the end of the first quarter through July 22, almost twice the drop of the S&P 500 in that time. Still, real estate professionals said Amazon's step back from its aggressive industrial expansion in many cases has created opportunity for other users in what has become a historically tight industrial market across the country.

"Other users that have effectively been crowded out by Amazon will have an opportunity to come in," Bradley Tisdahl, CEO of Tenant Risk Assessment LLC, a firm that provides tenant credit reports for commercial landlords. "The subleases could wind up being great for some of these smaller users or midsize companies that could benefit from their exposure to Amazon's scale and reputation."

National Strategy

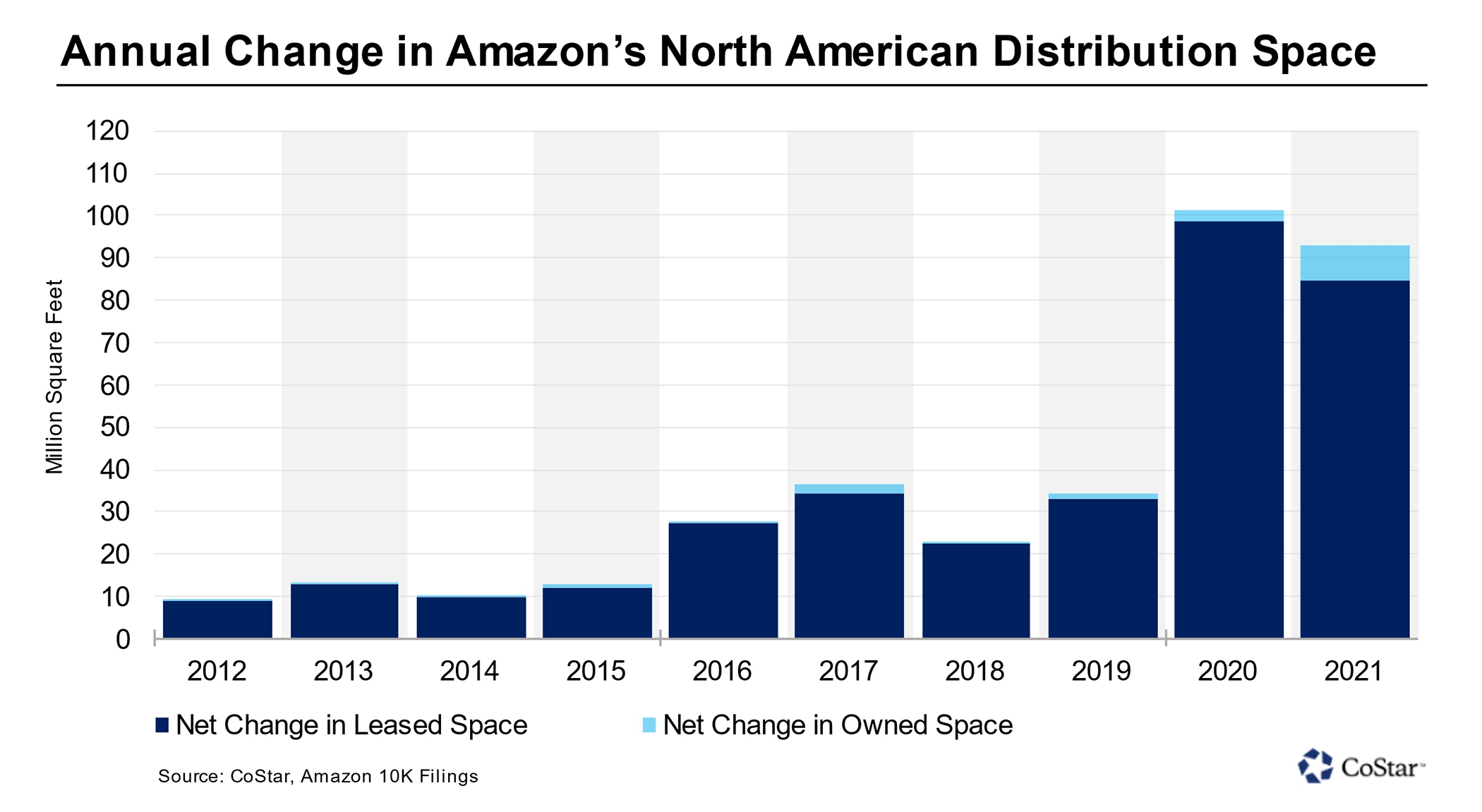

Amazon tripled the footprint of industrial and other commercial real estate it owns in North America from 2020 through last year, according to company filings.

It owned 5.6 million square feet of fulfillment, data center and other commercial property, excluding offices and physical stores, at the end of 2019. The e-tailer increased to 8.4 million square feet in 2020 and doubled that last year to roughly 16.7 million square feet, according to its annual reports.

As part of its aggressive acquisition strategy, Amazon has scooped up vacant land and underused shopping centers, offices and warehouses to build logistics centers as it moves to cut the cost of hiring outside developers and control a bigger slice of its vast warehouse and data center network.

"The opportunity to own key distribution warehouse assets not only puts them in control but also eliminates the ever-present double-digit rent growth," said Abby Corbett, managing director and senior economist in CoStar's market analytics group.

She noted that the company's owned portfolio is still dwarfed by the amount of square footage it leases. Amazon nearly doubled its leased fulfillment and data center space in North America to more than 370 million square feet from 2020 to the end of last year, filings show.

"As these assets become more and more expensive, highly automated and crucial parts of supply chains, it's no surprise that Amazon and other retailers are saying, ‘I think I’d rather own,’ or are at least evaluating that decision more carefully," John Morris, president of Americas industrial and logistics for CBRE, told CoStar News.

Amazon's decisions to buy property rather than lease logistics space are "highly market- and submarket-dependent — whether Amazon has development partners that are slating up projects that appeal to it, and whether it feels the desire to control the space in that area," Corbett said.

With ownership comes Amazon's ability to better develop and run its logistics facilities in regions such as Southern California, where community movements to ban or limit warehouse development near neighborhoods have taken root, Bridge's Jones said.

"Amazon wants to control those sites because it’s getting so hard to get them entitled due to community and municipal opposition to traffic, trucks and other issues," he said.

Increased Ownership

If Amazon's real estate strategy is shifting — the company has been mum on its intentions — it has a ways to go. The company owns less than 5% of its logistics and IT facilities in North America.

It has continued to buy property even as it trims space elsewhere, even rolling out so-called megawarehouses of up to 100 feet tall from New Jersey to Southern California.

The company last month acquired a 102-acre site north of Interstate 10 in Desert Hot Springs, a small city north of Palm Springs in Southern California's Inland Empire, where city planners in March approved a warehouse that would be among the largest in the United States at 3.4 million square feet, according to city and public sale documents.

Also in June, Amazon bought 40 acres northeast of Minneapolis from local developer Rehbein Properties for what local media outlets reported is a planned 140,000-square-foot delivery center. And in April, Amazon Data Services, the company's data center arm, bought 58 acres in Gainesville, a Northern Virginia suburb southeast of Washington, D.C.

Amazon has not disclosed its plans for the Virginia land, which is next to another large parcel acquired by the e-commerce giant last year. However, Northern Virginia's Prince William, Loudoun and Fairfax counties, an area known as "Data Center Alley," are among the nation's most active regions for data center development.

Amazon in April also bought 70 acres of industrial land north of Tampa, Florida.

While it buys up real estate, the company has scrapped or postponed plans this year for industrial projects by other developers on its behalf that it would lease in such states as California, Iowa, New Jersey, New York and Pennsylvania, according to CoStar News and various local news outlets.

The e-tailer recently walked away from talks with the Port Authority of New York and New Jersey for one of the biggest proposed projects, an investment totaling more than $400 million to lease and redevelop two cargo facilities at Newark Liberty International Airport as an air-freight hub.

Evolving Plans

Amazon did not address questions from CoStar News about the status of its active projects, its plans for the recently acquired land or potential changes to its logistics real estate strategy. The company issued a statement similar to many other recent responses to media outlets inquiring about its real estate.

“Like all companies, we’re adapting to the availability of real estate and location of our customer demand, and we’re also constantly evaluating our approach based on our financials," Amazon spokesperson Kelly Nantel said in the emailed statement. "Our plans continue to evolve, and we’re unable to confirm future builds or launches.”

The company said in April that it added too many warehouses and employees in nearly doubling the total square footage of its distribution network in the United States since the onset of the pandemic in early 2020. The company could offload up to 30 million square feet, according to published reports. That's about 8% of its U.S. industrial real estate holdings, which totaled 387 million square feet of leased and owned space at the end of last year, CoStar data shows.

Amazon could provide an update on its real estate activities when it releases second-quarter 2022 earnings on Thursday.

The company's disclosure that it would shed warehouse space following a first quarter earnings loss — its first since 2015 — was among a litany of worrisome headlines this year that included rising consumer and business prices and Russia’s invasion of Ukraine in early March that contributed to global supply chain disruptions.

However, analysts, including executives of the world's largest commercial real estate brokerage, CBRE, and Prologis, one of Amazon's biggest industrial landlords, have mostly shrugged off the concerns.

CBRE's Morris said the public and market reaction to Amazon's pullback is overblown.

'Very Strategic'

“This is not a fire sale," he told CoStar. "They’re going to be very strategic about what capacities and facilities they delay. Their leadership says that they've built a supply chain for 2025. It's just not 2025 yet."

Morris said his market sources across the United States tell him that Amazon will shed less than 10 million square feet, mostly space under its Amazon Logistics warehouse platform known as AMZL, from which the e-tailer makes last-mile deliveries to customers.

"I don’t know every deal in the country, but I’ve only heard of two unique subleasing deals going through," Morris said. "There are a couple of sites that they didn’t close on or are working out their options. But any development that is anywhere near complete they’re finishing, and any lease commitment, they’re leasing but maybe not occupying just yet."

Prologis has received sublease inquiries from Amazon on just two of the 132 spaces it leases from the company and heard of only one Amazon space available for sublease during its calls with national brokerages last week, Chief Customer Officer Mike Curless said during the developer's most recent earnings call.

“We have zero [Prologis spaces] in play," Curless said. "What matters is what we're seeing on the ground, and we're not seeing much at all.”

Prologis officials have said Amazon is mostly only backing out of warehouse space that it hasn't yet occupied, hired workers for or outfitted with its high-tech robotic equipment, or at locations where it can easily transfer logistics to neighboring facilities.

One of the Prologis buildings subleased by Amazon is a warehouse in the San Francisco East Bay area city of Hayward. Modular homebuilding startup Veev last month agreed to sublet the 500,000-square-foot building.

Logistics Firms Step Up

If Amazon is making a strategic retreat from some of its industrial real estate obligations, it has created an opportunity for others.

The industrial vacancy rate nationwide stands at less than 4%, according to CoStar. In the Los Angeles region, which includes the nation's busiest port complex, the vacancy rate is below 2%, and in close-in areas, there are fewer than a half-dozen Class A spaces larger than 100,000 square feet available.

With Amazon on the sidelines, there is more room for other users to grab what space there is.

A mix of firms from third-party logistics firms to large retailers such as Walmart are still playing catch-up to Amazon, Tenant Risk Assessment's Tisdahl said.

With little to no space available in Los Angeles and other big logistics hubs, any Amazon sublease space should fill up quickly, he added.

Since Amazon slowed its national warehouse leasing at the end of the first quarter, six other companies, including such retailers as Bed Bath & Beyond, Target and Puma, have leased more square footage than the e-commerce giant, which has dominated industrial absorption since 2020, CoStar data shows.

Amazon so far appears to be giving up mostly smaller spaces, with more than three-quarters of Amazon-occupied industrial spaces listed as available for lease or sublet at less than 150,000 square feet, according to CoStar's latest national industrial report.