The real estate sector got a boost from the lower-than-expected United States inflation figure released on Tuesday, which was reinforced by sharply falling United Kingdom inflation on Wednesday.

The EPRA NAREIT index UK surged 6.8% on Tuesday and added another 0.8% today. The United States index rose by 5.3%. The positive momentum was not limited to real estate investment trusts as big brokers like CBRE and JLL also saw their shares rally.

Headline inflation in the United States fell to 3.2% from 3.7%, which was below market expectation of 3.3%. The sharp drop caused a stock and bond market rally, while the dollar dropped against the euro and sterling.

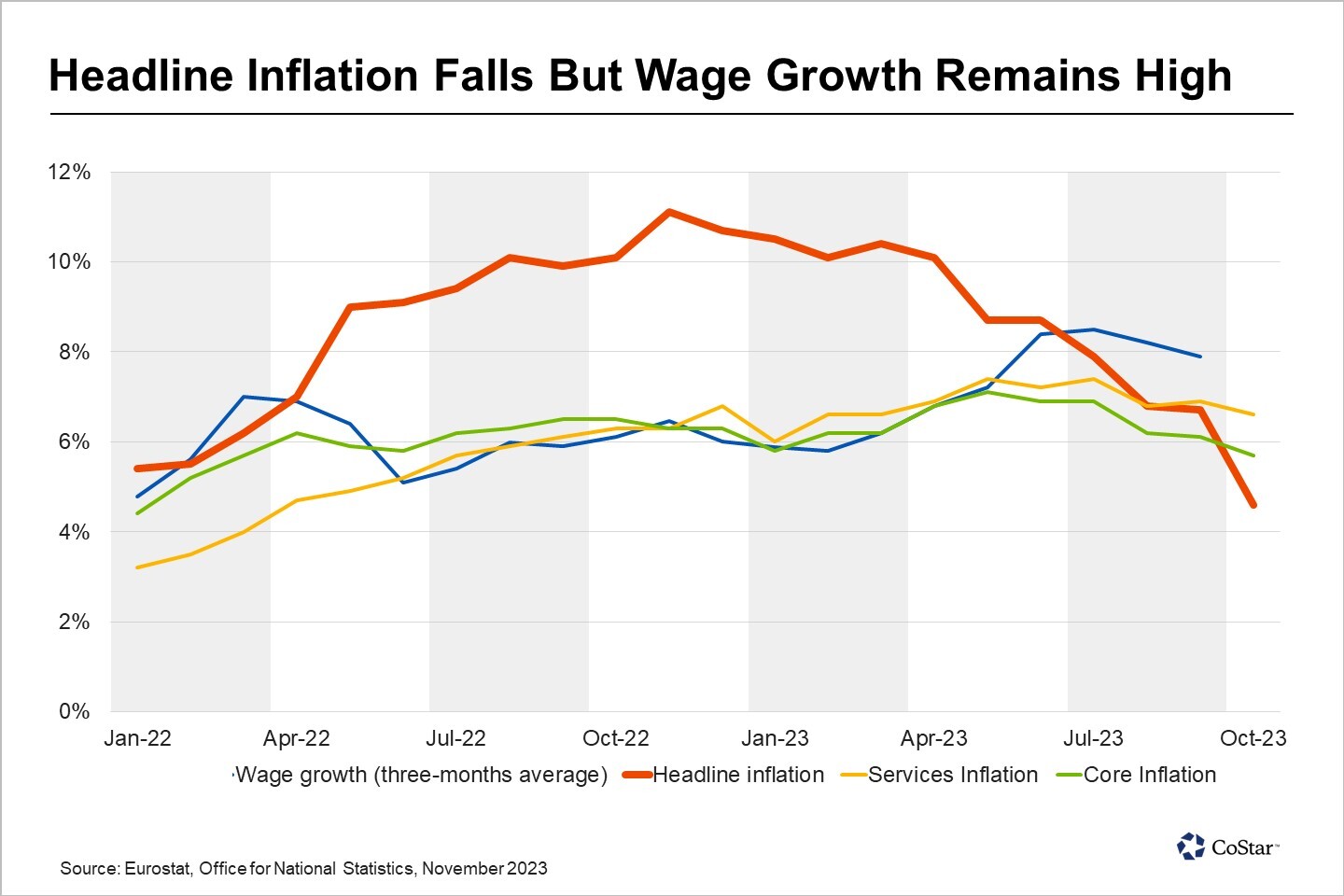

On Wednesday, the Office for National Statistics released the October inflation figures with headline inflation dropping sharply to 4.6% from 6.7% in September. This was below the forecast of 4.8% the Bank of England provided earlier this month when it decided to hold its rates.

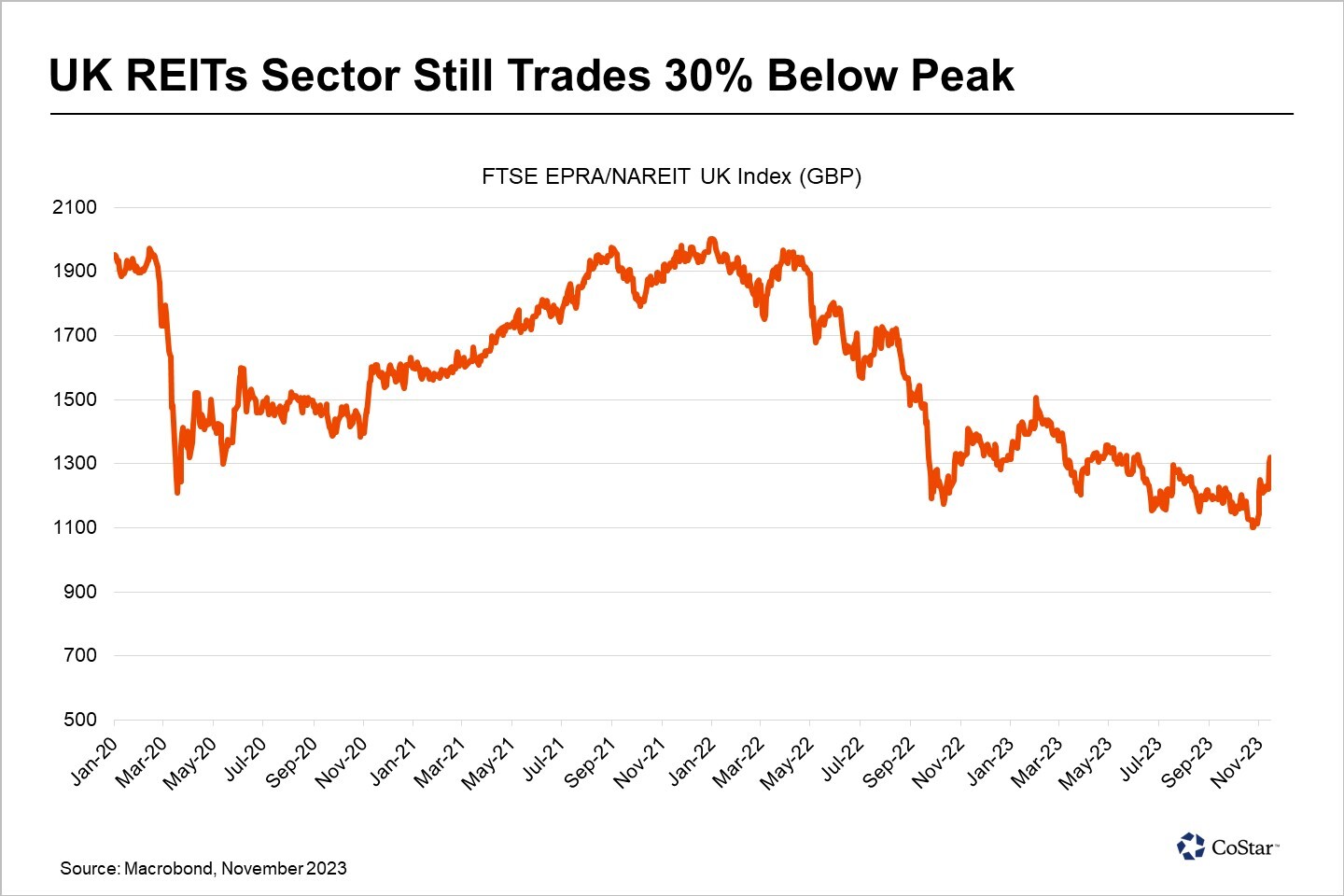

With the eurozone, the United States and the United Kingdom all reporting falling inflation, investors are becoming more confident that inflation headed for the 2% target and that further rate hikes are no longer necessary. Real estate is considered to benefit from lower rates and investors returned to the sector, which is still trading some 30% below its peak before the hiking cycle.

Despite the buoyant market reaction, core inflation, which excludes volatile energy, food, alcohol and tobacco, remains elevated in the United Kingdom. In October, it reached 5.6%, down from 6.1% in September. Goods inflation fell sharply to 2.9% but services inflation was 6.6% compared to 6.9% in September.

Wage growth also remains high in the United Kingdom. The Office for National Statistics released the latest figures earlier this week with the average annual wage growth for the three months to September coming in at 7.9%. This was partly explained by one-off payments for civil servants made in July and August 2023 to cope with the rising cost of living.

The Bank of England will be closely watching this trend, as it has gone on record that it fears that rising wages can undo the effects from higher interest rates. In other words, if wage growth does not slow down, the Bank feels it must keep bank rates higher for longer.

Nevertheless, REIT investors will enjoy the boost from lower inflation expectations, which could set the stage for price discovery in the real estate markets when assets start trading again. With rates seen as settled, focus will now shift to tenant risk and the impact on cashflows and profitability. Sales volumes are at record lows with only £24 billion traded in 2023 so far, way below the £55 billion recorded in 2022, according to CoStar data.

Improving visibility on leasing trends and a settled interest rate environment should lift the sector, though, and with the United Kingdom's REIT sector bouncing off its post-pandemic low from only 21 days ago, sentiment appears more positive. Brokers no doubt will hope that this translates in a rebound of the investment market in 2024.

However, the Bank of England will be closely studying the November inflation figures to determine if core inflation is indeed coming down closer to its 2% target. The Bank is set to announce its decision on bank rates on the 14 December and the November inflation figures are scheduled to be released six days later.