CoStar for Lendersのパワー

CoStarの業界をリードする物件データ、マーケット分析、実証済みのクレジットデフォルトモデルにマッピングされたローンポートフォリオにより、自信を持ってリスクを管理し、情報に基づいた融資決定を下し、規制当局に対する信頼性を強化できます。

動画を視聴

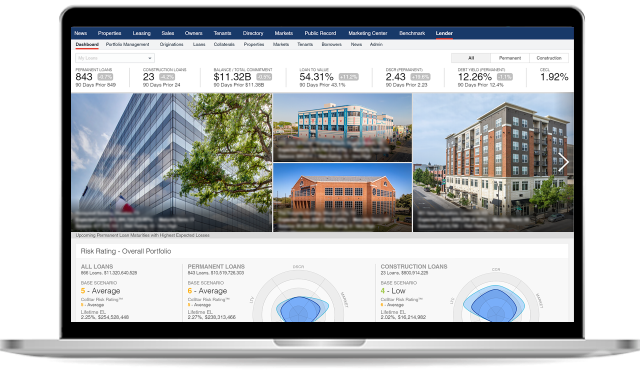

ポートフォリオをライブデータと高度な分析に連携

マーケット、サブマーケット、借主、テナント、物件タイプなどに基づいて、ポートフォリオをセグメント化します。LTV、DSCR、予想損失率、負債利回りなどのライブ指標をモニタリングします。

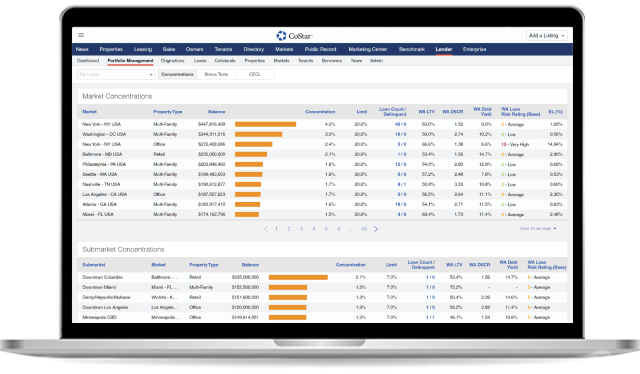

不安定な環境下におけるポートフォリオリスク管理チームの強化

集中リスク、リファイナンスのリスク、ローンのリスク格付け、CECLの正確な分析を容易に実施できます。トップダウンのカスタマイズ可能なシナリオとボトムアップのローン特性の両方を活用して、ストレステストを実施できます。

規制プロセスにおける信頼を築き、効率性を確保

実績のあるクレジットモデルと最新のきめ細やかで防御可能なデータを統合することで、より高い信頼性と精査への耐性を備え、規制当局に適時に報告できます。

LenderがCoStarを選ぶ理由

商業用不動産マーケットの調査にこれほど投資する会社は他にありません。その結果、広範かつ正確なデータが得られ、情報に基づいた意思決定ができます。

730万軒の

物件を追跡

2,000万件の

販売物件およびリース物件の比較対象

830万の

テナント

18年の

COMPASSクレジットデフォルトモデル

あらゆる規模の融資機関が頼りにする、信頼できるツールとインサイトを活用しましょう。

CoStarが貴社のビジネスにどのように役立つかをご覧ください。

888-226-7404までお問い合わせいただくか、このフォームを送信してデモをリクエストしてください。