It has been another busy Mipim real estate conference in Cannes, France, where tens of thousands of people met at the industry's largest global forum to discuss everything from the return to office, responding to sustainability demands and higher-for-longer interest rates.

There were big announcements from the brokers, including Newmark's expansion in France and Avison Young's debt-for-equity recapitalisation, with the chief executives of both joining CoStar News for video interviews to discuss them. Avison Young's Mark Rose called cost-cutting "a thing of the past" as Barry Gosin of Newmark said the company plans to expand in Europe and beyond.

There were major capital raising drives and investment platform launches from the likes of Valesco and Schroders, as revealed by CoStar News, huge lending news such as Cushman's mandate on the €720 million refinancing of Finance Tower in Brussels, and and plenty of people moves, new initiatives and major sales launches.

CoStar News revealed one of the largest shopping centre sales of recent years is close to happening, while at the Metrocentre, the owner and the local council are pursuing massive expansion plans, including residential property. CoStar News caught up with chiefs from JLL, Savills, Colliers, Cushman & Wakefield, IWG, Prologis and many more to hear their latest, and all of these videos will be available on the website in the coming days.

Standout talking points included improving figures on United Kingdom office occupancy and the United Kingdom economy, vigorous debate around diversity and inclusivity and about the upcoming General Election.

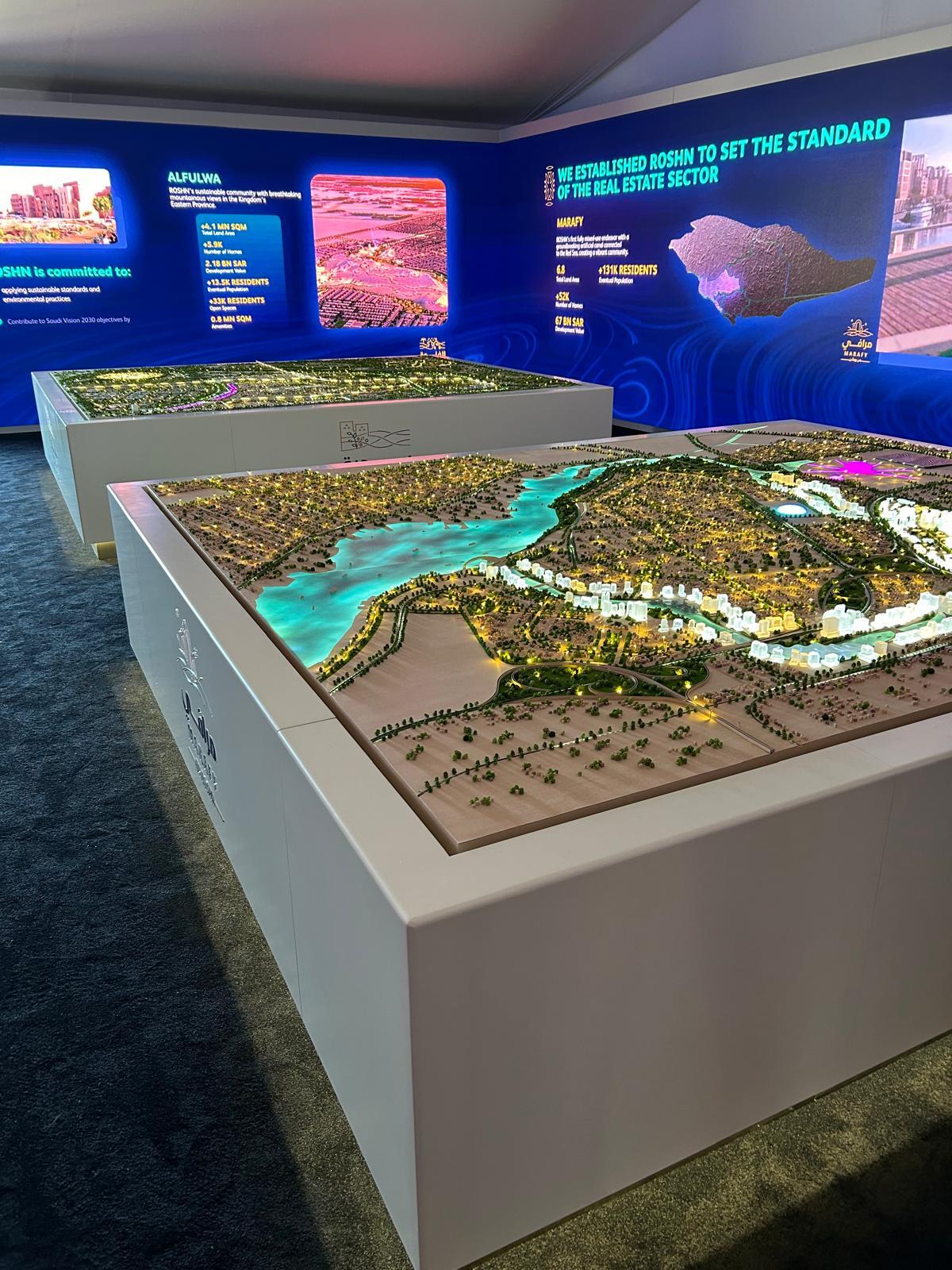

Global elections, a continued search for evidence that deals are actually being done to push the market forward, and the sheer bling of the Saudi Arabian pavilion were other major discussion points.

And there were some great phrases to sum up the market and the mood doing the rounds. "Do more in 24" is a more optimistic call to action than last year's "survive until 2025" catchphrase from German real estate conference Expo Real in October. The "juice isn't worth the squeeze" made its way over from the United States, to mean a deal isn't worth doing.

It was, however, a quieter and calmer Mipim than normal, partly reflecting the fact that there was no major external event unfolding, such as last year's troubles with American regional banks and then Credit Suisse, or the prior year's response to Russia's aggression in Ukraine. But it was also a reflection of a lack of deal announcements and perhaps less presence from some areas of the market, such as the public sector and sustainability focused institutions.

Don't Go Big, Go Better

As one participant put it, this was not a "Mipim to go big on things" even with clear signs that the market is getting better in a host of areas.

JLL United Kingdom and EMEA chief Stephanie Hyde put it well by saying the market was moving on from "navel gazing" on key topics. She said the return to the office is happening, with occupiers and landlords settling on "3.1 days a week" as real estate focuses on thinking about how to make properties more environmentally sustainable, but it needs more action, and technology is fundamental.

Colin Wilson, chief executive, EMEA, Cushman & Wakefield, put it another way: “There is a wait-and-see feel this year but, nevertheless, also with the sense that there is something forming on the horizon that is giving reasons for optimism. It has really been back to fundamentals after the buoyancy following the end of lockdowns, with the cost of capital, for instance.

"As a business, we have been focused on ensuring our service offer is supporting our clients where they need us across the ecosystem, whether investing in the expansion of our Living platform, or our Rethinking solution for office assets at risk of obsolescence.”

Two major themes for the conference itself were diversity and sustainability.

The taxi driver on the way to the conference greeted me with "Ah yes, it is blue-suit week again in Cannes" to reference Mipim's long-standing reputation for being awash with middle-aged white men in blue suits. And yes, I was wearing a blue suit.

So have things changed this year?

There still were a lot of men in blue suits but there is definitely a more serious manner among those attending and were more senior presentations from a wider selection of people.

Real Estate Balance, the lobbying group, hosted some of the more interesting panel debates, at the London Stand. One featured heads of diversity and inclusion from JLL, Savills and Knight Frank who had ditched their usual rivalry to collaborate on best practice for improving the environment in real estate.

Topics included how to deal with client and internal bad actions and how to flag inappropriate conversations. All of the three leading agents are now providing diversity and inclusion champions who people can approach privately, but also are reviewing policies to reform systemic problems. "There should be zero tolerance no matter how many deals a person does," was one comment.

There was an interesting debate around how the built environment can be used to help staff who have disabilities or are feeling isolated, such as stickers on bathroom mirrors to help people know who to contact for mental health issues. The conversations pointed to an industry making progress by deciding these are issues that can only be solved by collaboration.

JLL's Hyde said the industry was undoubtedly moving in the right direction. "I am impatient for it to be quicker but it really is happening."

Sustainability Struggles

On sustainability, the United Kingdom government's inertia on whether it will legislate on net zero carbon emissions for commercial real estate after it pushed back its commitment to do so on residential is causing a lack of direction.

Chris Cheap, principal, managing director, transactions, Avison Young, said he had been surprised there had not been more emphasis on retrofit and stranded assets and affordable workspace at the conference.

"The regions represent a huge opportunity for change here but I have seen evidence of what I would term [Minimum Energy Effficiency Standards] deniers. I expect the general election will see a [political] party emerge that understands it needs to have a strong message around MEES.

"What I have noticed a little this year is the capital is not keeping pace with the opportunity. It is difficult to retain affordable workspace in regional cities but it is vital for companies to grow. In Manchester a good example is Booking.com which started in around 1,500 square feet above a Pret a Manger. I think there needs to be government policy to reduce ambiguity and protect affordable workspace."

RICS's President Tina Paillet had arrived in Mipim from attending the Buildings and Climate Global Forum in Paris, where RICS experts briefed energy and climate ministers on the environmental challenges facing the built environment and the tools and solutions the group is developing and deploying in 2024.

She was extremely upbeat on progress being made across the industry and by governments: "We are here to continue on from what started in Paris where 70 countries committed to regulation with a single declaration for reducing carbon emissions in buildings. Regulation is vital as it levels the playing field by ensuring that low carbon materials, for instance, are there for real estate companies. The point is that those who do move towards retrofitting will find it immensely profitable. Next governments need to look at tax breaks and incentives to help atomise green financing out to smaller projects."

Sentiment and Recovery

So what is the consensus on the state of the market?

Rob Wilkinson, chief executive of AEW Europe, describes sentiment as "a bit better" then the third quarter of last year when inflation looked more difficult. "By the end of the year there was a settling down and a real sense of dilution of the problems. That trajectory has not continued entirely but people are more positive."

Wilkinson says there are two areas holding back a major improvement in sentiment.

"Firstly don't underestimate the psychological impact of the last 12 months, investors take time to regain confidence and that will be a challenge for longer than we might like. There is more interest but it is with more caution. There is not a massive difference among our global clients but there is a differentiation in terms of where the portfolio is allocated. Some European investors in particular were majorly allocated towards bonds and were hit suddenly and real estate became a huge part of the portfolio so they are now in a different place.

"The second challenge is in financing. What has still not been seen yet is the impact of higher interest rates. The level of refinancing is not the same as the [global financial crisis] but more equity will have to be injected and that does have a dampening effect. The returns on debt now are much better than say two years ago. Returns are closer to equities."

James Sparrow, chief executive, United Kingdom and EMEA, Savills, says the market is unquestionably more positive than 12 months ago.

"Since the New Year the wall of capital has been growing that is looking to deploy. In terms of the context of the conference there is more intent and this is the first time people have really had the chance to get together this year. We are seeing opportunistic investors increasingly looking to call the bottom of the market."

Jason Winfield, head of capital markets for the United Kingdom and Ireland at Cushman & Wakefield, says it is logical that the market is ready to pick up in terms of property cycles. "We have had eight successive quarters of falling transactional volumes."

"Typically property cycles show falling volumes for eight to 10 quarters. It is my belief that transactional volumes will start to increase in the second half of this year, but given it takes four to six months for deals to commence and then conclude, it will likely be 2025 before the market settles into equilibrium."

Andrew Hawkins, senior London capital markets adviser at CBRE, is clear that London offices are in the middle of a recovery in activity, although leasing of the top 10% of office space has remained strong throughout.

"The yield spread compared to the rest of Europe in London is wider than ever. If you combine cheaper yields, London employment growth and forward-looking swap rate curves alongside debt that is accretive, it is all combining to mean trading is more active."

The £250 million-and-above market is still a way off being active again, but Hawkins said brokerage CBRE is working on a good number of sizeable transactions.

"The market has been about ultra-high-net-worths and family offices and transition funds with brown to green strategies. The good news is US investors really are back. They have recognised that the office market is perhaps different in London to what is being seen in San Francisco or Manhattan."

Makoto Fukui, head of central London at fund manager Schroders, says that the fundamentals around the occupational story have been "pretty good but capital markets have taken a hammering" for the past 18 months.

"But I am not sensing the market panicking around debt covenants. Mipim is a good barometer. Most people have spent this period getting together a plan. But we do need a fall in interest rates, not even that much, but that would change sentiment and that is what is important."

Retail and logistics owner and developer Eurofunds' senior adviser Mike Rhydderch was in particularly upbeat mood. "It is slightly different on the retail side. We have been in the sinbin as a sector for a while and really now things are a lot brighter. We are seeing more permanent core capital becoming curious about the sector. That is because tenants are operating really well and yields are attractive."

The Silverburn shopping centre owner is looking at acquisitions across its preferred European markets. They are still focused on the United Kingdom, Germany, Spain, Portugal and Italy "and have been building our platform for instance with two senior recent hires in Germany."

The company has been strongly linked to acquisitions in Spain and Germany, which Rhydderch declines to discuss. The group is very keen to buy another major shopping centre in the United Kingdom, he says, but is being held back by the number of sales that involve stakes where the passive partner in the joint venture is selling.

Hospitality Booming

One area that is clearly booming is hotels as those traveling for leisure have returned after lockdowns.

Felicity Black-Roberts, vice-president of acquisitions and development for Europe at Hyatt, says: "The truth is the ongoing interest in investing in the hospitality sector is very high. Other asset classes are not faring so well, retail and offices for instance, and new investors want to get in while existing mainstay ones want to expand and have more exposure and would move further afield to resorts and secondary cities. The frustration is people can't find enough product."

"The point is leisure and business travellers, as human beings, you can feel we need to be around one another, creativity comes from that. The great thing here at Mipim is you see so many people and you get the pulse and the investor perspective. We are here educating people about what Hyatt wants. I have been speaking to two office owners from Stockholm saying to me could the buildings be a hotel. I have said, yes, they could."

To underscore the sector's appeal, CoStar News revealed during the confidence that Schroders has raised an initial £100 million for a United Kingdom hotel fund.

Deals Needed

But deals are really needed despite the positivity and Mipim was a bit quiet for them.

Tony Horrell, chief executive, United Kingdom and Ireland, at Colliers says in a video interview the market is still looking for clarity and confidence and "we are not there yet" on a number of things, not least interest rates.

"There is also the problem of development being a bit of a dirty word really at the moment and we need that to change and for development to stack up. The number of deals that are reported this week is important, we need momentum."

Ben Cook, Cushman & Wakefield's head of City of London capital markets, says the deals are definitely coming but not necessarily quickly enough to make the first quarter look strong: "In 2023, investors were focused on when the bottom of the London market would be reached. This has changed completely in 2024 with investor confidence returning faster to London than in many other global gateway cities, and buyers now seeking to place capital into London whilst there remains an opportunity to purchase attractive assets at cycle-low pricing.

"The inherent attractions of London also mean that buyer sources remain extremely diverse. Domestic investors dominated the market last year, but we continue to see a wide range of purchasers from Europe, Asia, the Middle East" with a number of United States investors also returning.

"The positive investor activity in the market today is more accurately indicated by the £2 billion-plus of transactions that are now under offer across Central London.”

Andrew Thomas, director, head of international capital at Colliers, is tracking money from South East Asia in particular. "That is going to be coming into London and it is important to say that is not just Singapore as it is there that capital is syndicated from Taiwan and other jurisdictions."

Timothé Rauly, global co-head real estate at AXA IM Alts, the European investment management giant, says the market is unquestionably different and quieter than two years ago. His company was behind one of the biggest stories at the conference, its £480 million agreed development financing from Cale Street for its next major City of London tower at 50 Fenchurch Street,

"Transactions are down because there is less capital available while questions remain around, where is the capital? But things are still clearer. Interest rates will be higher for longer but it is ultimately not that messy for real estate. The split across our portfolio is operationally we are performing exceptionally well but a question remains over the yield performance with all real estate. We are 30% resi, 30% logistics, 20% office and the rest is hotels and some form of what Europe still calls alternatives but is mainstream" in the United States.

New Sectors

As always there were plenty of people looking for new opportunities.

Rasheed Hassan, head of global crossborder investment at Savills, says Mipim is revealing people are far more committed to making more areas of the market work: "Of course beds and sheds everybody wants to invest there, but people are looking beyond that to offices and retail. The story on rents is very positive."

Rauly at AXA IM Alts said: "We are known for being first movers in areas, often by buying sector specialists, Kadans in life sciences, for instance, and in student homes, in data centres, and now in film studios with our Elstree acquisition, for instance.

"Areas we want to explore are self storage and cold storage, there will be a need here, and to replicate what we have done in Europe, for instance, in life sciences in Asia which we think is undersupplied."

And the strategy on debt is to accelerate. "We have reduced the size of the loan book in recent years but it is a €20 billion business and we are looking at capital raising for expansion here which will include moving up the risk curve because of better economics and lower leverage."

Shiraz Jiwa, chief executive of Valesco, which manages capital for global investors, revealed a major drive into London purpose-built student accommodation.

New Regions

The Newcastle stand was buzzing with development opportunities across the North East. Pam Smith, chief executive of the city council, said: "We have had great feedback. Part of it is all of the North East cities and authorities are collaborating and that is producing the best selection of investible opportunities" in the United Kingdom, adding, "the North East's time is now."

Among a string of major development opportunities being touted, CoStar News spoke to Martin Healy, chairman at Metrocentre, about plans for what amounts to a new town centre at the mega-mall in Gateshead.

Matthew Taylor, regional general manager of listed Hong Kong giant the Far East Consortium, was partly in town to remind people that the group was not just about its mega project at Red Bank Riverside in Manchester.

"Our broadest project is Manchester, our tallest is our resi tower and hotel in Canary Wharf with Clarion Housing, and our most unique is our town hall redevelopment in Hornsey."

It is looking very broadly around the United Kingdom. "We are looking at Deloitte's early stage soft marketing of huge regeneration around Temple Meads in Bristol, the Barking Riverside project in east London, Birmingham city council's asset sales and major development in Oxford and Cambridge. We are also looking at garden villages which can be single family and more cookie-cutter."

Mipim Messages

Most people came with a message, about their company and their strategy.

David Ebbrell, chief executive of Oxford Properties-owned pan-European company M7, says the company has changed its business leadership and strategy recently so Mipm is important to make sure that message comes across. "We are focused on urban logistics and retail parks where 85% of our assets are. New lettings have taken occupancy from 86% to 88% in the last year although a lot of that happened in the final quarter. Here we are getting a good idea of where the occupier market sits. The gap was wide between buyer and seller but that has narrowed and we are optimistic. The conversations here are validating that."

Selena Ohlsson, director for real estate client solutions, Federated Hermes, says the conference is about reconnecting and building networks. "It has been a challenging period for equity raising but allocations are coming back into the market." The United Kingdom is "hitting a point where pricing is more attractive particularly as it has been hit earlier by value falls. International investors are seeing that.

"Our allocations are invested in big projects that can deliver huge regeneration so that helps our conversations."

Avison Young's Chris Cheap says his company's recapitalisation has been important. "We are in a position now to invest strategically in key growth areas such as the West End, our flexible offices offer. We have now taken the pain in a way some of our competitors have not and we are in a good place. Talent will gravitate towards us."

Return to Office and Looking to the Future

Lorna Landells, real estate consultant at Remit Consulting was in Mipim to provide some good news. Remit's latest figures show United Kingdom office occupancy at its highest level since the lockdowns ended.

With so much being discussed across La Croisette it can be easy to forget the sheer amount of presentations and debates going on in the Palais and out and about. The event saw leading politicians from across the globe pressing the flesh with investors and participants at keynote addresses and in pavilions. That included opening ceremony speaker Sanna Marin, the former Prime Minister of Finland; Guila Clara Kessous, the UNESCO Peace Ambassador; and from the UK, Lord Johnson, the investment minister and Lee Rowley MP, the housing minister, from the United Kingdom.

The Mipim Awards picked out 11 developments from around the world across sectors for special mention while research papers were unveiled across a startling number of areas.

Remit also published a British Property Foundation-endorsed survey of the industry on Artifical Intelligence and adoption. The consultant's Landells says Mipim has been a "bit ageist this year" on that front.

"There have been a few panels where everyone speaks as if the over 50s have no chance of understanding AI. One good thing I heard about AI was from Anton [Newton] at Pinsent Masons who said it is a bit like using a SatNav. You can use it but you also need to keep your eyes on where you are going. On a positive note there are more people here who are serious and focused on meetings and getting things done. But I hope it does not lose the party spirit. That is vital."

- article19 Min ReadMarch 15, 2024 10:24 AMThe view from La Croisette at the world's largest real estate conference.

- article1 Min ReadMarch 14, 2024 04:58 PMCoStar News spoke with the brokerage's top executive at a large European Real Estate Show.

- article1 Min ReadMarch 15, 2024 05:27 AMInterest rate uncertainty is still leading to a cautious market but a flurry of deals would push momentum.

- article12 Min ReadMarch 15, 2024 05:16 AMThe right environment is required to deliver billions of pounds worth of projects, UK property leaders argue.

- article1 Min ReadMarch 14, 2024 02:59 AMEdge chief executive Coen van Oostrom says the project is too big and complex for a private solution.

- article1 Min ReadMarch 13, 2024 04:08 PMHere's what people are talking about at the world's largest real estate show.

- article1 Min ReadMarch 13, 2024 03:24 PMCoStar News talked with the longtime brokerage leader at a European real estate show.

- article4 Min ReadMarch 13, 2024 10:00 AMInvestors and advisers compare outlooks at the annual gathering in the French Riviera.

- article1 Min ReadMarch 13, 2024 12:38 PMHyde says the market has moved on from return to the office, technology 'navel gazing' and sustainability.

- article1 Min ReadMarch 13, 2024 04:57 AMHere's what people are talking about at the world's largest real estate show.

- article3 Min ReadMarch 12, 2024 01:39 PMSome industry professionals call the connections made at a global property gathering in France hard to beat.

- article1 Min ReadMarch 12, 2024 12:33 PMCoStar News and sister title Business Immo talk global expansion, moving to US dollars and putting WeWork in perspective.

- article3 Min ReadMarch 12, 2024 09:32 AMFrançois Blin, chief business officer, and Emmanuel Frénot, deputy chief business officer, of Newmark France, talk about their hiring, growth and the American company's regional ambitions.

- article3 Min ReadMarch 11, 2024 01:58 PMNicolas Kozubek has sweated the details and knows all eyes will be on him at this week's Mipim property show.

- article2 Min ReadMarch 12, 2024 05:47 AMSurvey finds industry needs to urgently invest in both the technology and training staff to use it.

- article12 Min ReadMarch 11, 2024 09:51 AMCoStar News catches up with leading industry figures to discuss an increasingly global event.

- article4 Min ReadMarch 12, 2024 05:01 AMThe Urban Land Institute and PwC report finds plenty of reasons to be cheerful.

- article2 Min ReadMarch 11, 2024 03:10 AMThe US brokerage has hired seven staff from rival firms.

- article4 Min ReadMarch 14, 2024 11:03 AMSamir Amichi is positive about the opportunities ahead.